Why Selling Without an Agent Can Cost You More Than You Think

Cutting out the agent might seem like a smart way to save when you sell your house. But here’s the hard truth.

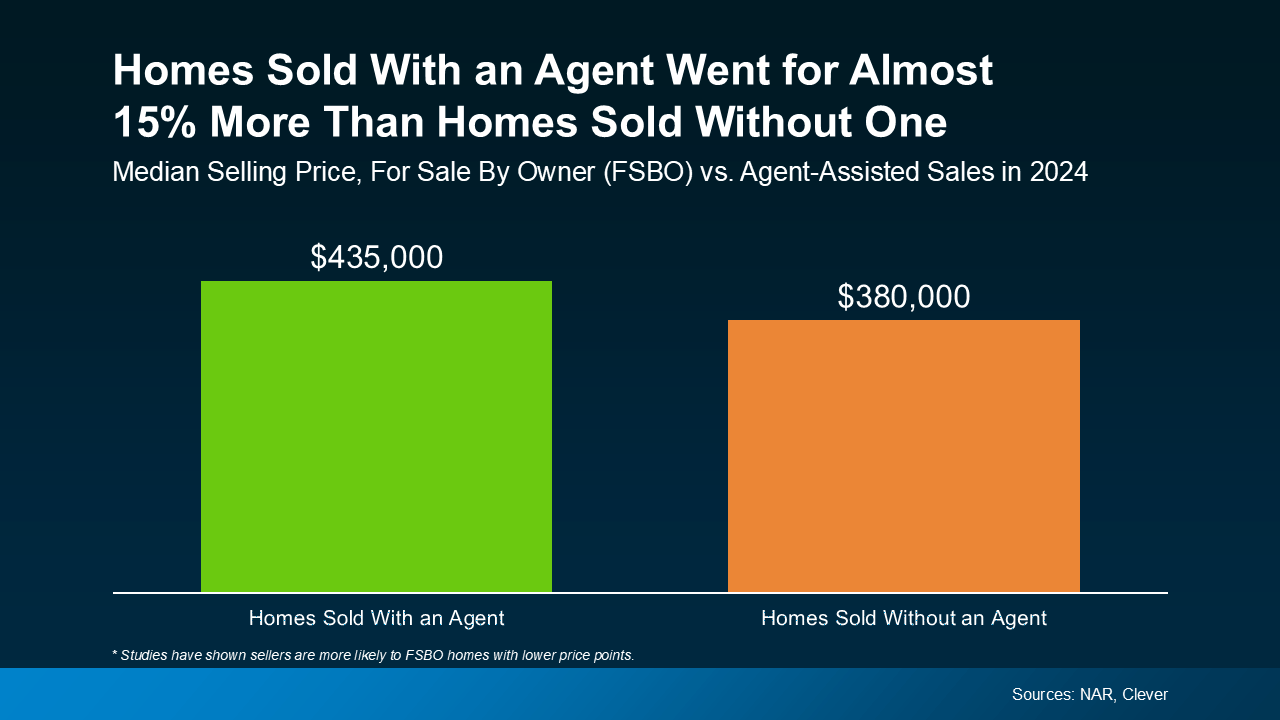

Last year, homes that sold with an agent went for almost 15% more than those that sold without one.

That gap is pretty hard to ignore. And with more homes on the market to compete with right now, selling on your own is a mistake that’s going to cost you.

That gap is pretty hard to ignore. And with more homes on the market to compete with right now, selling on your own is a mistake that’s going to cost you.

This Isn’t the Market for DIY Selling

A few years ago, you might’ve gotten away with a “For Sale By Owner” (FSBO) sign in your yard, navigating the process on your own. That’s because homes were flying off the market and buyers were pulling out all the stops. But that’s just not the case anymore. With more inventory than we’ve seen in years, we’re not in a “list it and they will come” market anymore. You need professional expertise.

A yard sign and some photos you take on your own won’t cut it.

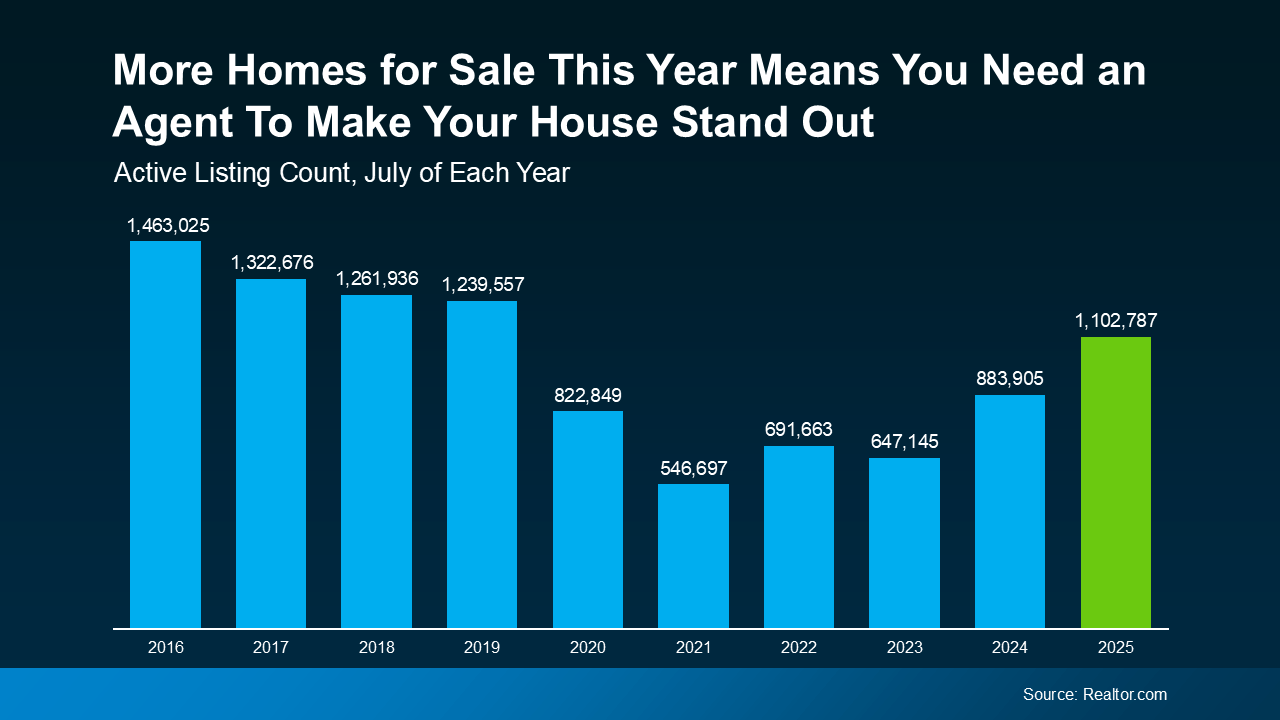

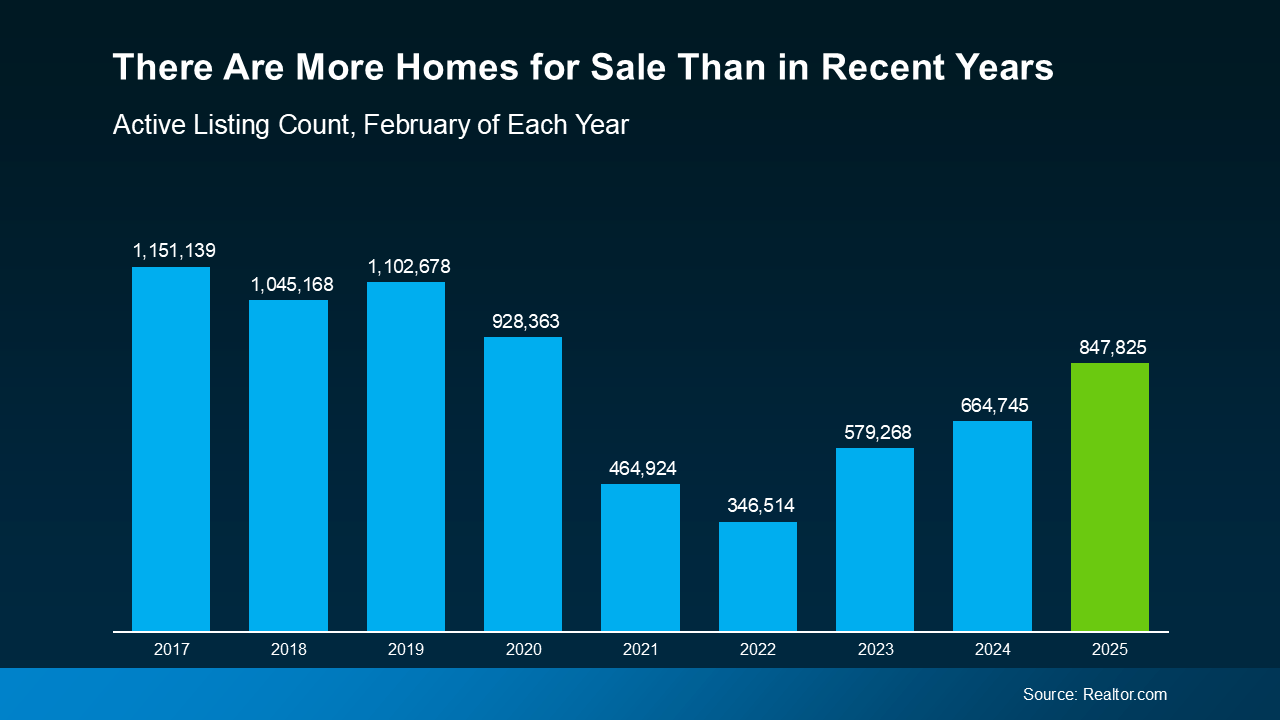

Right now, the housing market is getting back to what most would consider a more normal balance of buyers and sellers, and that really changes the game. According to Realtor.com, the latest number of listings for sale was the highest it’s been in any month of July since 2019 (see graph below):

And while inventory growth is going to vary by local market, nationally, this graph shows the number of homes for sale is inching back toward normal.

And while inventory growth is going to vary by local market, nationally, this graph shows the number of homes for sale is inching back toward normal.

With more listings available, that means buyers can be more selective. They’ll compare your home to others on price, condition, photos, location, and more. If yours doesn’t stand out, it will get skipped over.

More Inventory = More Competition for You

Selling today requires the latest pricing strategy, expert prep work, professional marketing, and strong negotiation skills. And if you’re not bringing all of that to the table, chances are, you’re going to feel it in your bottom line.

More Homeowners Are Turning To the Pros

That’s why even more home sellers are working with agents today. Data from the National Association of Realtors (NAR) shows a record-low percentage of homeowners sold without an agent last year. And the few sellers who tried to sell on their own realized their mistake pretty quickly.

According to Zillow, 21% of homeowners ended up hiring an agent anyway after struggling to sell on their own.

So, why take the risk? With a local pro, you’ll have:

- Pricing precision to attract buyers and maximize your return

- Expert staging and presentation advice to highlight your home’s best features

- Pro-level marketing, including the best exposure and access to buyer networks you can’t reach on your own

- Skilled negotiation to evaluate offers and navigate inspections, protecting your bottom line

- Local market expertise that helps your listing stand out based on what inventory looks like in your area

An agent’s expertise isn’t optional anymore. It’s essential.

Bottom Line

In a market with more listings and pickier buyers, many sellers who try to sell on their own end up working with an agent anyway. So why not start there?

Let’s connect so you have a pro who knows exactly what it takes to sell your house in today’s market, for the best possible price, without leaving money on the table.

Reach out if you want a professional assessment on what your house could sell for today.

Selling and Buying at the Same Time? Here’s What You Need To Know

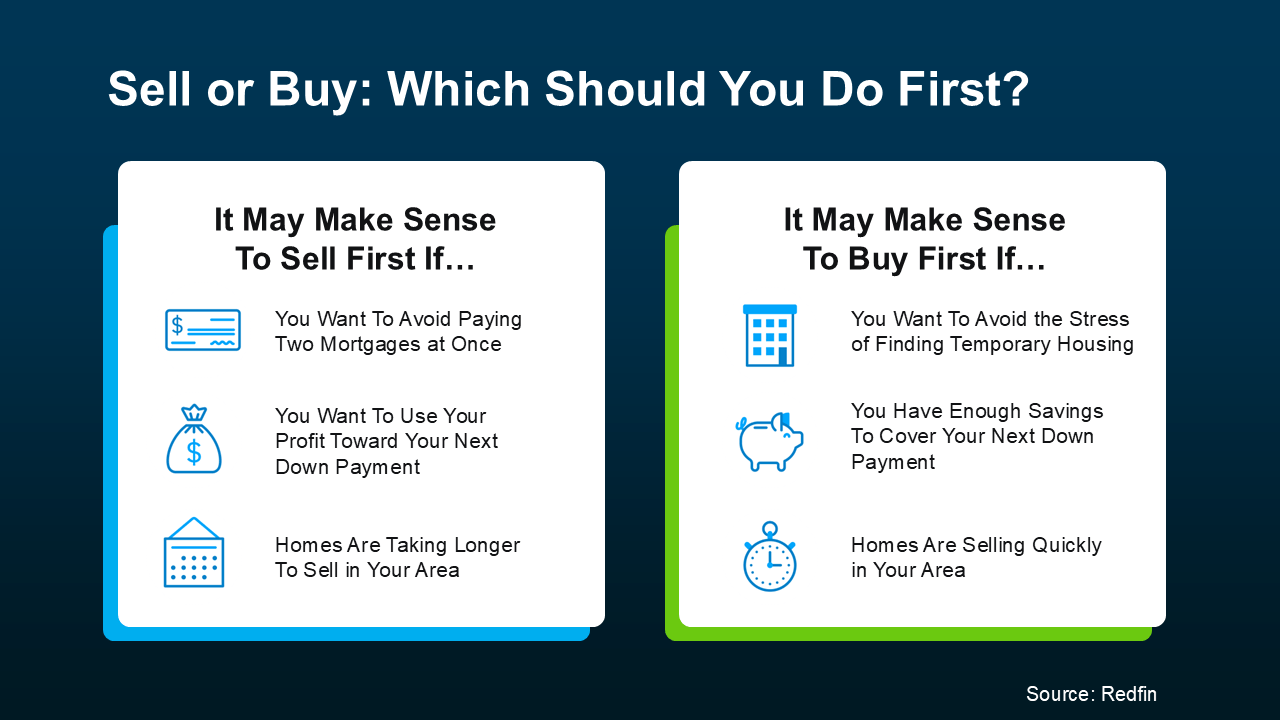

If you’re a homeowner planning to move, you’re probably wondering what the process is going to look like and what you should tackle first:

- Is it better to start by finding your next home?

- Or should you sell your current house before you go out looking?

Ultimately, what’s right for you depends on a lot of factors. And that’s where an agent’s experience can really help make your next step clear.

They know your local market, the latest trends, and what’s working for other homeowners right now. And they’ll be able to make a recommendation based on their expertise and your needs.

But here’s a little bit of a sneak peek. In many cases today, getting your current home on the market first can put you in a better spot. Here’s why that order tends to work best (and how an agent can help).

The Advantages of Selling First

1. You’ll Unlock Your Home Equity

Selling your current home before you try to buy your next one allows you to access the equity you’ve built up – and based on home price appreciation over the past few years, that’s no small number. Data from Cotality (formerly CoreLogic) shows the average homeowner is sitting on $302K in equity today.

And once you sell, you can use that equity to pay for the down payment on your next house (and maybe even more). You could even have enough to buy your next house in cash. That’s a big deal, and it could make your next move a whole lot easier on your wallet.

2. You Won’t Be Juggling Two Mortgages

Trying to buy before you sell means you could wind up holding two mortgages, even if just for a few months. That can get expensive, fast – especially if there are unexpected repairs or delays. Selling first removes that stress and helps you move forward without the financial strain. As Ramsey Solutions says:

“It’s best to sell your old home before buying a new one to avoid unnecessary risks and possible headaches.”

3. You’ll Be in a Stronger Position When You Make an Offer

Sellers love a clean, simple offer. If you’ve already sold your house, you don’t need to make your offer contingent on that sale – and that can help you stand out. Your agent can position your offer to be as strong as possible, so you have the best shot at getting the home you want.

This can be a big advantage in competitive markets where sellers prefer buyers with fewer strings attached.

One Thing To Keep in Mind

But, like with anything in life, there are tradeoffs. As you weigh your options, consider this potential drawback, too:

1. You May Need a Place To Stay (Temporarily)

Once your house sells, you may need a short-term rental or to stay with family until you can move into your next home. Your agent can help you negotiate things like a post-closing occupancy (renting the home from the buyer for a set period) or flexible closing dates to help smooth out that transition as much as possible.

Here’s a simple visual that can help you think through your options (see below):

But the best way to determine what’s best for you and your specific situation? Talk to a trusted local agent.

But the best way to determine what’s best for you and your specific situation? Talk to a trusted local agent.

Bottom Line

In many cases, selling first doesn’t just give you clarity, it gives you options. It helps you buy with more confidence, more financial power, and less pressure.

If you’re ready to make a move but you’re not sure where to begin, let’s talk. We can walk through your potential equity, your timing, and your local market conditions so you can decide what’s right for you.

The Truth About Where Home Prices Are Heading

There are plenty of headlines these days calling for a housing market crash. But the truth is, they’re not telling the full story. Here’s what’s actually happening, and what the experts project for home prices over the next 5 years. And spoiler alert – it’s not a crash.

Yes, in some local markets, prices are flattening or even dipping slightly this year as more homes hit the market. That’s normal with rising inventory. But the bigger picture is what really matters, and it’s far less dramatic than what the doom-and-gloom headlines suggest. Here’s why.

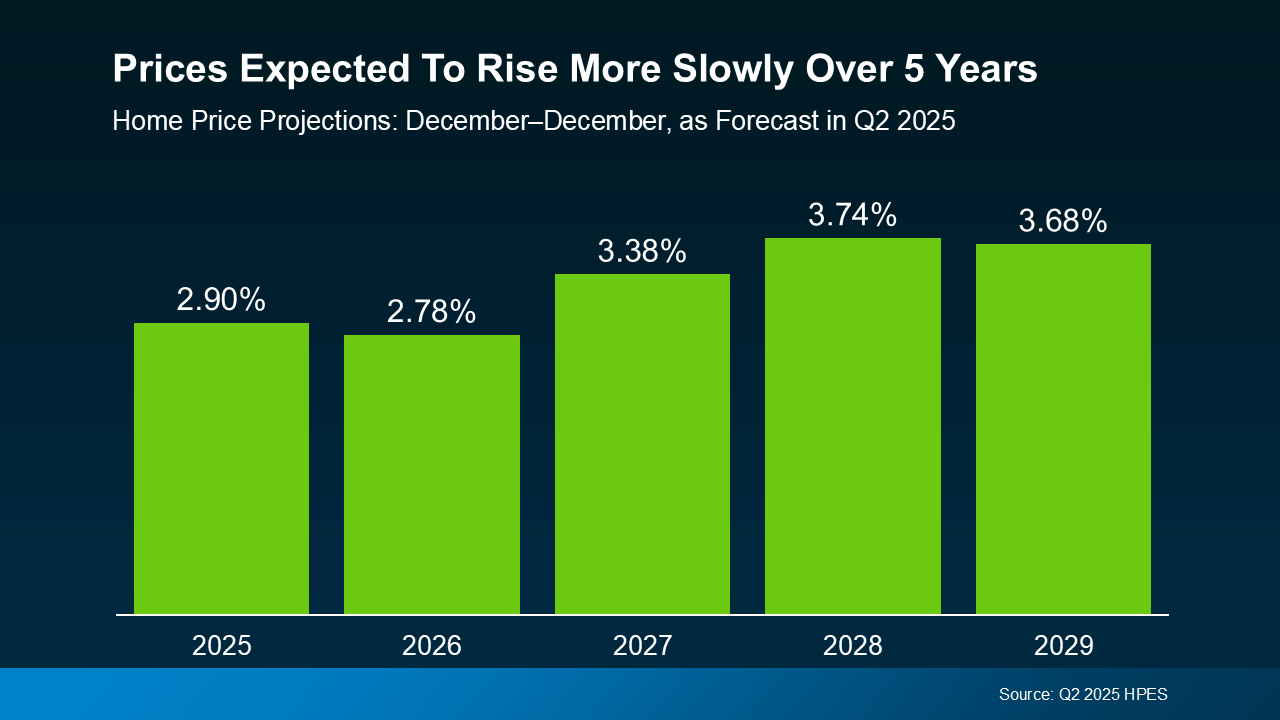

Over 100 leading housing market experts were surveyed in the latest Home Price Expectations Survey (HPES) from Fannie Mae. Their collective forecast shows prices are projected to keep rising over the next 5 years, just at a slower, healthier pace than what we’ve seen more recently. And that kind of steady, sustainable growth should be one factor to help ease your fears about the years ahead (see graph below):

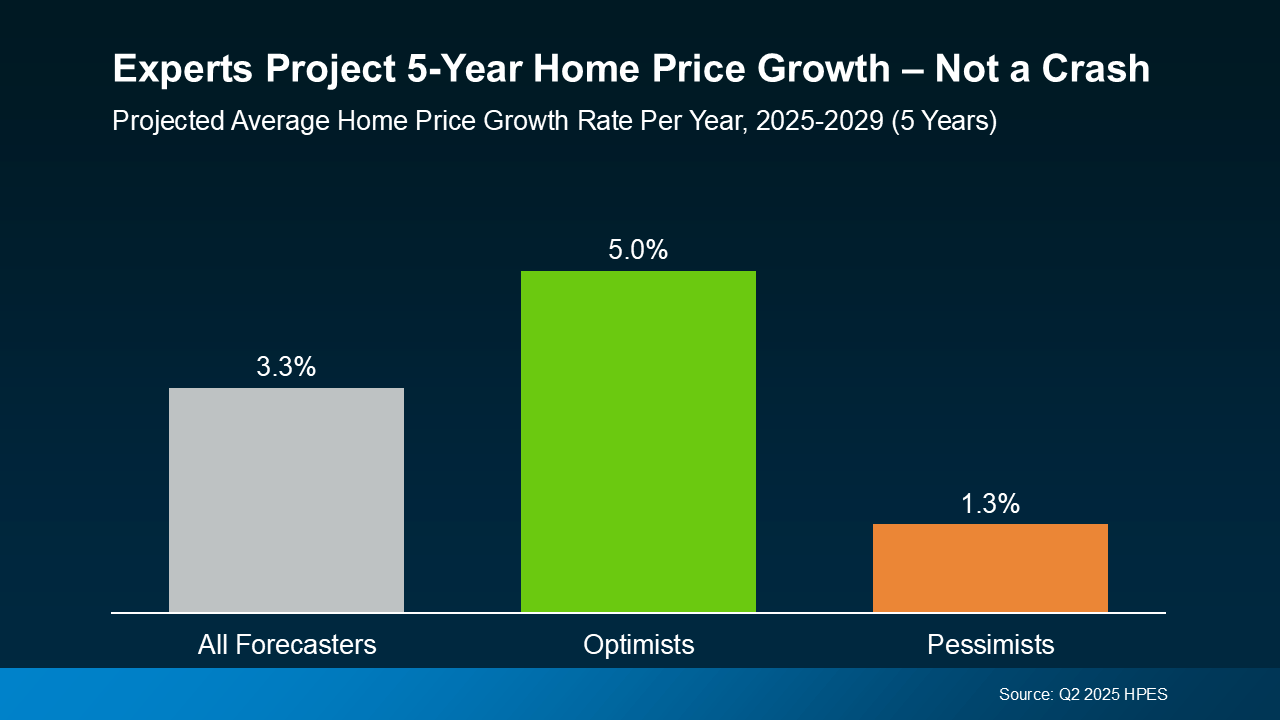

And if you take a look at how the various experts responded within the survey, they fall into three main categories: those that were most optimistic about the forecast, most pessimistic, and the overall average outlook.

And if you take a look at how the various experts responded within the survey, they fall into three main categories: those that were most optimistic about the forecast, most pessimistic, and the overall average outlook.

Here’s what the breakdown shows:

- The average projection is about 3.3% price growth per year, through 2029.

- The optimists see growth closer to 5.0% per year.

- The pessimists still forecast about 1.3% growth per year.

Do they all agree on the same number? Of course not. But here’s the key takeaway: not one expert group is calling for a major national decline or a crash. Instead, they expect home prices to rise at a steady, more sustainable pace.

That’s much healthier for the market – and for you. Yes, some areas may see prices hold relatively flat or dip a bit in the short term, especially where inventory is on the rise. Others may appreciate faster than the national average because there are still fewer homes for sale than there are buyers trying to purchase them. But overall, more moderate price growth is cooling the rapid spikes we saw during the frenzy of the past few years.

And remember, even the most conservative experts still project prices will rise over the course of the next 5 years. That’s also because foreclosures are low, lending standards are in check, and homeowners have near record equity to boost the stability of the market. Together, those factors help prevent a wave of forced sales, like the kind that could drag prices down. So, if you’re waiting for a significant crash before you buy, you might be waiting quite a long time.

Bottom Line

If you’ve been on the fence about your plans, now’s the time to get clarity. The market isn’t heading for a crash. It’s on track for steady, slow, long-term growth overall, with some regional ups and downs along the way.

Want to know what that means for our neighborhood? Because national trends set the tone, but what really matters is what’s happening in your zip code. Let’s have a quick conversation so you can see exactly what our local data means for you.

Why Some Homes Sell Faster Than Others

Why Some Homes Sell Faster Than Others

As you think ahead to your own move, you may have noticed some houses sell within days, while others linger. But why is that? As Redfin says:

“. . . today’s housing market has been topsy-turvy since the pandemic. Low inventory (though rising) and high prices have created a strange mix: Some homes are flying off the market, while others sit for weeks.”

That may leave you wondering what you should expect when you sell. Let’s break it down and give you some actionable tips on how to make sure your house is one that sells quickly.

Homes Are Still Selling Faster Than Pre-Pandemic

The first thing you should know is that, in most markets, things have slowed down a little bit. While you may remember how quickly homes sold a few years ago, that’s not what you should expect today.

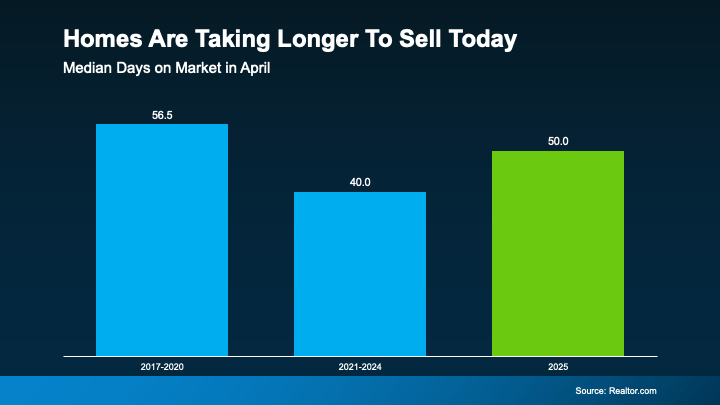

Now that inventory has grown, according to Realtor.com, homes are taking a bit longer to sell in today’s market (see graph below):

But before you get hung up on the ten-day difference compared to the past few years, Realtor.com will help put this into perspective:

But before you get hung up on the ten-day difference compared to the past few years, Realtor.com will help put this into perspective:

“In April, the typical home spent 50 days on the market . . . This marks the 13th straight month of homes taking longer to sell on a year-over-year basis. Still, homes are moving more quickly than they did before the pandemic . . .”

By this comparison, if your house does take a little more time to sell this year, it’s not really a concern. It’s actually still faster than the norm. Plus, it gives you a bit more time to find your next home, which is welcome relief when you’re trying to move, too.

Just remember, some homes sell in less time than this. Some take even longer. So, what’s the real difference? Why do some homes attract eager buyers almost instantly, while others sit and struggle?

It comes down to having the right agent and strategy. Here are a few tips you need to know.

1. Price It Right

One of the biggest reasons homes sit on the market is overpricing. Many sellers want to shoot for a higher price, thinking they can lower it later – but that backfires by turning buyers away.

What to do: Work with an agent to make sure your house is priced right. They’ll analyze recent comparable sales (what other homes have sold for recently in your area), so you know you’re pricing appropriately for today’s market and what buyers are willing to pay. As Chen Zhao, Economic Research Lead at Redfin, explains:

“My advice to sellers is to price your home fairly for the shifting market; you may need to price lower than your initial instinct to sell quickly and avoid giving concessions.”

2. Focus on the First Impression

A messy yard or a house that needs paint? It’ll turn buyers off. Since buyers decide within seconds whether they like a home, a good first impression is key.

What to do: Outside, clean up your front yard, tidy up your landscaping, power wash walkways, and add fresh mulch. Inside, declutter and depersonalize. And consider minor touch-ups like repainting in a neutral tone. Your agent will offer advice on what to tackle.

3. Strong Marketing & High-Quality Listing Photos

If your listing or your photos don’t look professional, you could have trouble drawing in buyers who think you’re trying to cut corners.

What to do: Instead, lean on your agent’s skills, expertise, and resources. They’ll help you make sure you have:

- High-resolution listing photos showing the home in its best light.

- Detailed descriptions that highlight differentiating features of your house.

- Your listing on multiple platforms, including major real estate sites and social media.

4. The Location of the Home

You may have heard the phrase “location, location, location” when it comes to real estate. And there’s definitely some truth to that. Homes in highly sought-after neighborhoods tend to sell faster.

What to do: While you can’t change where your house is located, your agent can highlight the best features of your neighborhood or community in your listing. By showcasing what’s great about your area, they can help draw buyers into what life would look like in your house.

Bottom Line

Homes that sell quickly don’t necessarily have better features – they have better agents and a better strategy.

Are you thinking about selling? Let’s talk about how to get your home sold quickly and for top dollar.

Buyers Have More Negotiation Power – Here’s How To Use It

You may have heard there are more homes for sale right now. And while that’ll vary depending on the market, it means that overall, things are starting to lean in a more balanced direction. As that happens, some sellers are a bit more open to compromise. Here’s what that means for you.

You may be regaining some negotiating power. That can translate into savings, perks, or even better terms on your purchase – if you know what levers to pull during negotiation.

Why an Agent Is an Essential Part of the Negotiation Process

The complicated part is knowing what is and isn’t on the table. That’s where your agent comes in. According to the National Association of Realtors (NAR), besides finding the right home, the top thing buyers want from their agent is help negotiating the terms of the sale, followed by negotiating the price.

Here’s why. Agents are skilled negotiators and are trained for moments like this. Since your agent is an expert on the local market, they’ll also know what’s working for other buyers (and what’s not), and that can help you get a better understanding of what’s realistic to ask for.

What’s on the Negotiation Table?

Here are some of the most common concessions an agent can help you negotiate:

- Sale Price: The most obvious concession is the price of the home. And that lever is being pulled more often today. Buyers don’t want to overpay when affordability is already so tight. And sellers who aren’t realistic about their asking price may have to consider adjusting their price.

- Closing Costs: Closing costs are usually about 2-5% of a home’s purchase price and include fees for things like the appraisal, title insurance, and underwriting of your loan. To offset the cash you have to bring to the table, you can ask the seller to pay for some or all of these expenses. This was the most common concession sellers made in 2024, according to NAR.

- Home Warranties: If you’re worried about the maintenance costs that may pop up after you get the keys, you can ask the seller to pay for a home warranty. Since this concession usually isn’t terribly expensive for the seller, it can be a good negotiation tool for a buyer. It’s not a big cost for them, but it can be a big perk for you.

- Home Repairs: Based on the inspection, you’re within your rights to ask the seller to make repairs. If the seller doesn’t want to, they could offer to drop the home price or cover some closing costs, so you have more room in your budget to take care of the repairs yourself.

- Fixtures: Want that washer and dryer to stay? Maybe the stainless-steel fridge, too? In many cases, you can ask for appliances or even furniture to be included in the deal, which will save you money when you move in.

- Closing Date: The closing date is also negotiable. Based on your timeline, you may also request a faster or extended closing window. Depending on the seller’s needs, this could be great for their situation, too.

Of course, negotiating is a complex process. And not every seller will be willing to offer concessions. Again, lean on your agent for expert advice about what’s realistic to ask for and what could turn sellers off.

Because once you’ve found a home you love, you don’t want to risk losing it. But you also want to get the best terms possible on your purchase – and that’s where an agent can make all the difference.

Bottom Line

As inventory grows, buyers are finding they have a bit more leverage. And having the right agent by your side – who can help you approach negotiations strategically – is key.

What’s your biggest concern when it comes to negotiating with a seller?

Let me know and we’ll put together a solid plan that makes things less stressful.

Here’s What a Recession Could Mean for the Housing Market

Recession talk is all over the news, and the odds of a recession are rising this year. And that leaves people wondering what would happen to the housing market if we do go into a recession.

Let’s take a look at some historical data to show what’s happened in housing for each recession going all the way back to the 1980s.

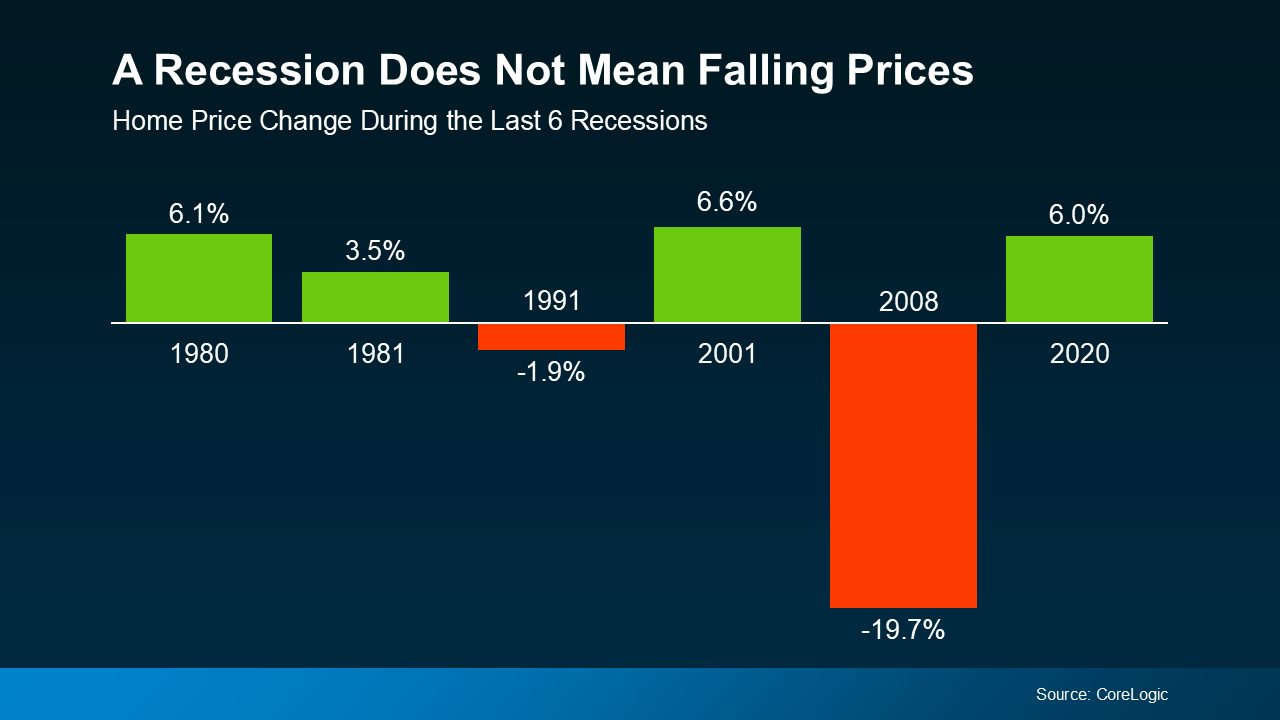

A Recession Doesn’t Mean Home Prices Will Fall

Many people think that if a recession hits, home prices will fall like they did in 2008. But that was an exception, not the rule. It was the only time we saw such a steep drop in prices. And it hasn’t happened since.

In fact, according to data from CoreLogic, in four of the last six recessions, home prices actually went up (see graph below):

So, if you’re thinking about buying or selling a home, don’t assume a recession will lead to a crash in home prices. The data simply doesn’t support that idea. Instead, home prices usually follow whatever trajectory they’re already on. And right now, nationally, home prices are still rising at a more normal pace.

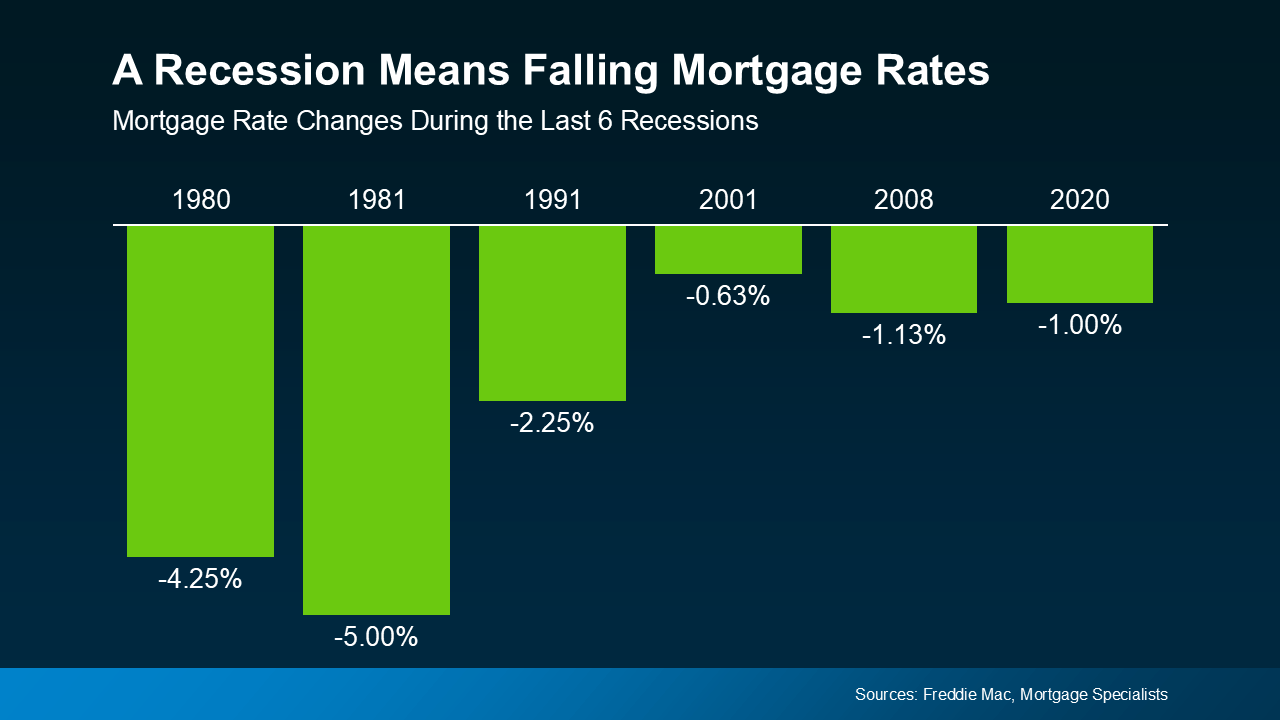

Mortgage Rates Typically Decline During Recessions

While home prices tend to stay on their current path, mortgage rates usually drop during economic slowdowns. Again, looking at data from the last six recessions, mortgage rates fell each time (see graph below):

So, a recession means mortgage rates could decline based on the data. While that would help with affordability, don’t expect the return of a 3% rate.

Bottom Line

The answer to the recession question is still unknown, but the odds have gone up. But that doesn’t mean you have to wonder about the impact on the housing market – historical data tells us what usually happens.

When you hear talk about a possible recession, what concerns or questions come to mind about buying or selling a home?

The Best Week To List Your House Is Almost Here – Are You Ready?

If selling your house is on your to-do list this year, the time to start prepping is now. That’s because experts say the best week to list your house is coming up fast.

A recent Realtor.com study analyzed years of housing market trends (excluding 2020 since it was an outlier) and found that April 13–19 is expected to be the ideal window to put your house on the market this year:

“. . . we’ve identified April 13-19 as the best week to list for sellers . . . a seller listing a well-priced, move-in ready home is likely to find success. Because spring is generally the high season for real estate activity and buyers are more plentiful earlier rather than later in the year, listing earlier in the spring raises a seller’s odds of a successful sale.”

What Makes This Week Stand Out?

As the quote mentions, spring is almost always a strong season for sellers. But this particular week could give you an even bigger advantage this year. Realtor.com goes on to say what listing during this sweet spot could mean for you:

- More buyers looking at your home since demand is high this time of year.

- A faster sale since serious buyers are eager to move before summer.

- A better chance of selling for top dollar. According to the study, you could get an average of $4,800 more this week (and $27,000 more than you would earlier in the year).

If You Want Your House on the Market for that Window, Act Now

With just a few weeks left before this prime listing window, you’ll need to make a plan to work smart and act fast. That’s where working with a great real estate agent comes in. They can help you:

- Figure out exactly what you need to do to get your house ready.

- Prioritize the tasks that’ll make the biggest impact in the shortest time.

- Decide if there are any quick fixes or small upgrades that could help you attract buyers.

Assuming your house is already in good shape, your focus should be on quick, high-impact updates. As Investopedia explains:

“You won’t have time for any major renovations, so focus on quick repairs to address things that could deter potential buyers.”

Here are a few examples of small projects that can make a big difference according to Redfin:

What If You’re Not Ready Just Yet?

Don’t worry – it’s okay if you don’t think you’ll be ready for this week. Just because April 13–19 is projected to be the ideal week by Realtor.com, that doesn’t mean it’s the only good time to sell. Even if you need a bit more time to get your home list ready, there’s still plenty of opportunity this homebuying season.

Bottom Line

If you’ve been waiting for the right time to sell, this could be it. But timing isn’t the only thing that matters – how well you prep and price your home is just as important.

What’s one thing you’d need to do before you’d feel ready to list? Let’s connect and figure out the best plan to make it happen.

Rising Inventory Means This Spring Could Be Your Moment

Want to know two reasons this spring might finally be your time to buy? Inventory has grown and sellers may be more willing to negotiate as a result. That means you’ve got more options and more power than buyers have had in years. Let’s break it down.

1. You Have More Homes To Choose From

The number of homes for sale this February was higher than it’s been in any of the past five Februarys – and that’s great news for your home search. The graph below uses the latest data from Realtor.com to show the supply of homes on the market has grown by 27.5% in just the last year:

More choices for your search is a good thing – and experts also say that inventory is projected to continue rising this year, which is even better. It means it should be easier to find something that checks your most important boxes. But that’s not all this does for you. Danielle Hale, Chief Economist at Realtor.com, explains some of the other perks of more inventory, beyond just having more homes to consider:

More choices for your search is a good thing – and experts also say that inventory is projected to continue rising this year, which is even better. It means it should be easier to find something that checks your most important boxes. But that’s not all this does for you. Danielle Hale, Chief Economist at Realtor.com, explains some of the other perks of more inventory, beyond just having more homes to consider:

“Buyers will not only have more home options . . . but they are also likely to find somewhat lower asking prices and more time to make decisions – all buyer-friendly factors as we inch closer to the busy homebuying season.”

2. You May Find Sellers Are Doing Price Cuts

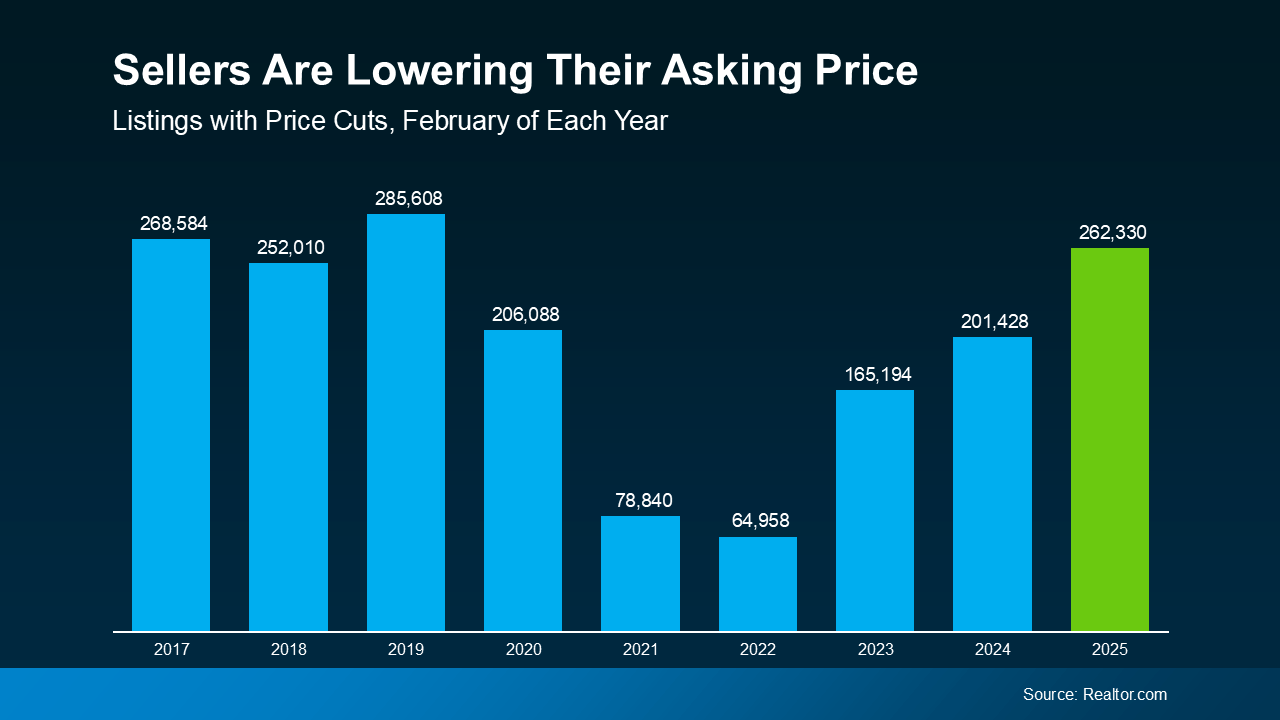

Now that buyers have more options, some homes are sitting on the market a little longer – especially those that were priced too high from the start. And the result is more sellers are having to drop their prices to draw buyers back in. Just take a look at the numbers.

According to Realtor.com, the number of listings with price reductions has gone up compared to the last few years (see graph below):

This is a sign sellers are more willing to compromise today. If you look back to more normal years in the market (2017–2019), you’ll see that the number of price cuts happening today is much closer to what’s typical – and for most buyers, that’s a big relief.

This is a sign sellers are more willing to compromise today. If you look back to more normal years in the market (2017–2019), you’ll see that the number of price cuts happening today is much closer to what’s typical – and for most buyers, that’s a big relief.

What does that mean for you? It could give you a better chance to negotiate – whether that’s on price, closing costs, or even repairs. While not every seller will adjust their price, more of them are willing to do it – giving you more leverage than buyers have in quite a while.

Bottom Line

If you’ve been on the sidelines, waiting for the right time to buy, this spring could be the opening you’ve been hoping for.

Of course, every market is different, and working with a local expert can help you work through your options. If you want to talk about what’s happening in our area or get started on your home search, let’s connect.

How does today’s rising inventory impact your homebuying plans?

Mortgage Rates Hit Lowest Point So Far This Year

If you’ve been holding off on buying a home because of high mortgage rates, you might want to take another look at the market. That’s because mortgage rates have been trending down lately – and that gives you a chance to jump back in.

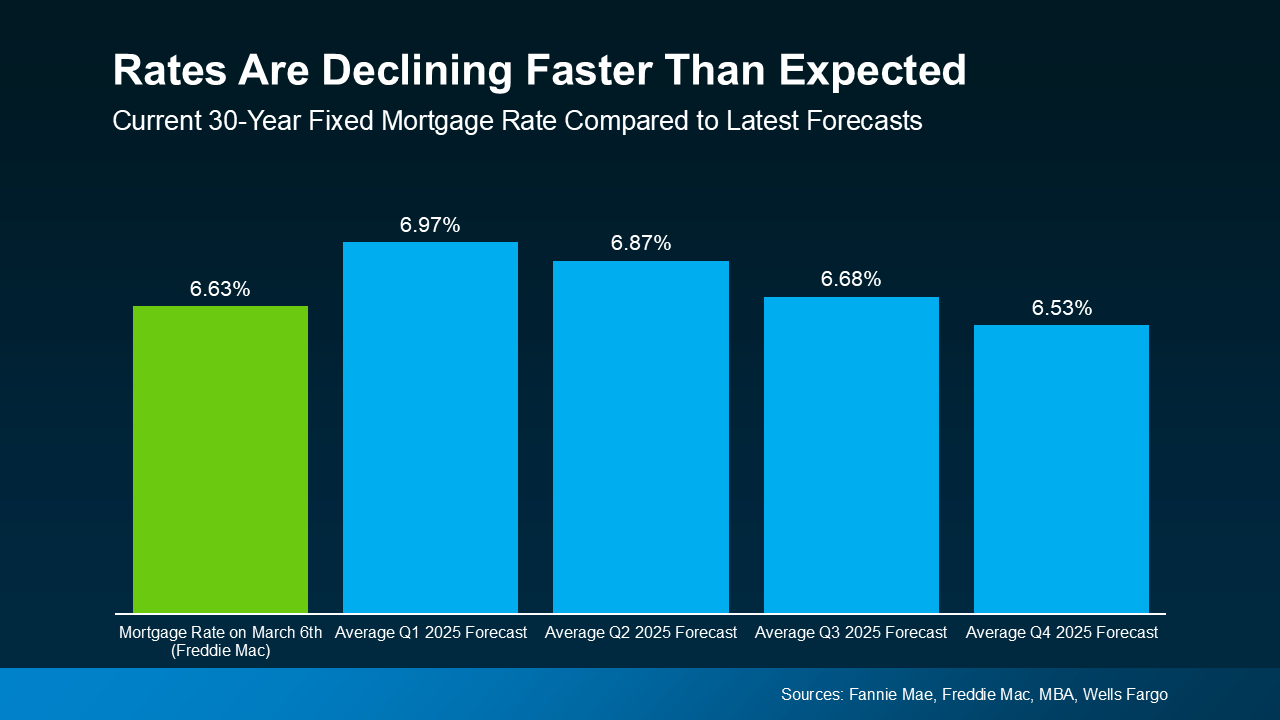

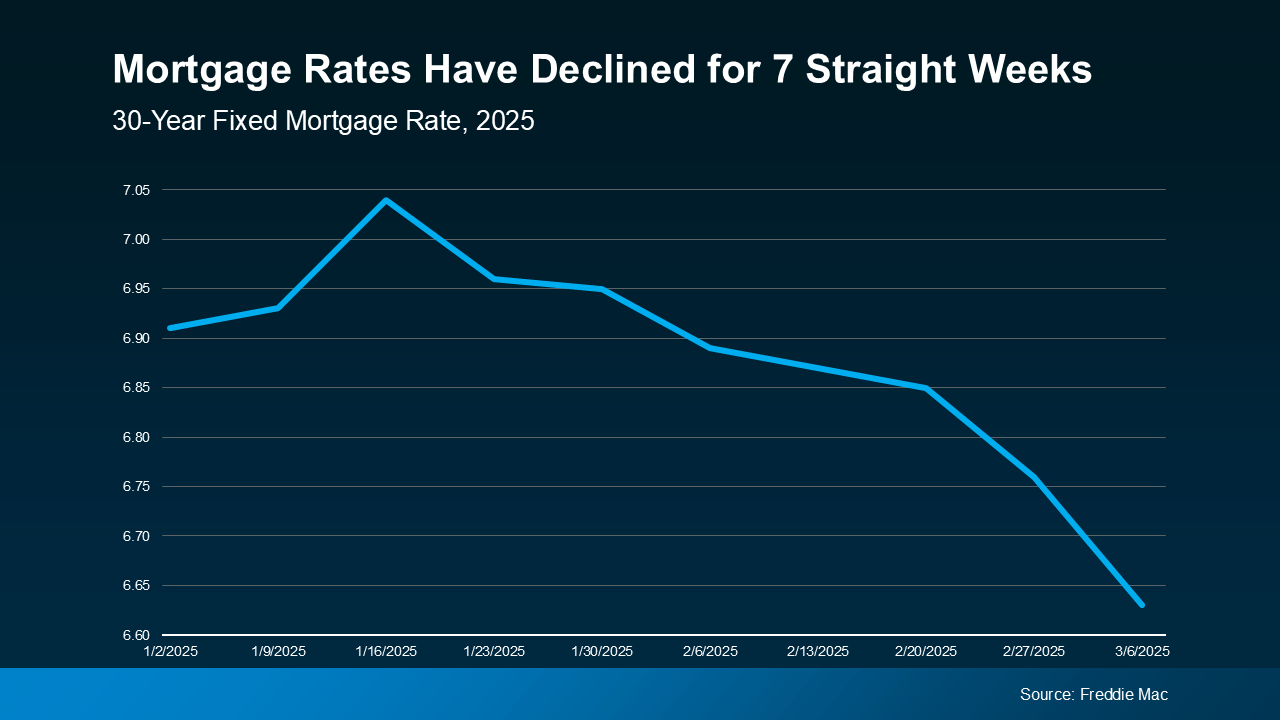

Mortgage rates have been declining for seven straight weeks now, according to data from Freddie Mac. And the average weekly rate is now at the lowest level so far this year (see graph below):

While that may not sound like a significant shift, it is noteworthy. Because the meaningful drop from over 7% to the mid-6’s can change your mindset when it comes to buying a home. Especially when the forecasts said we wouldn’t hit this number until roughly Q3 of this year (see graph below):

While that may not sound like a significant shift, it is noteworthy. Because the meaningful drop from over 7% to the mid-6’s can change your mindset when it comes to buying a home. Especially when the forecasts said we wouldn’t hit this number until roughly Q3 of this year (see graph below):

Why Are Rates Coming Down?

According to Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association (MBA), recent economic uncertainty is playing a role in pushing rates lower:

“Mortgage rates declined last week on souring consumer sentiment regarding the economy and increasing uncertainty over the impact of new tariffs levied on imported goods into the U.S. Those factors resulted in the largest weekly decline in the 30-year fixed rate since November 2024.”

And the timing of this recent decline is great because it gives you a little bit of relief going into the spring market. Just remember, mortgage rates can be a quickly moving target, so you should expect some volatility going forward. But the window you have as they’re coming down right now might be the sweet spot for your purchasing power now.

What Lower Rates Mean for Your Buying Power

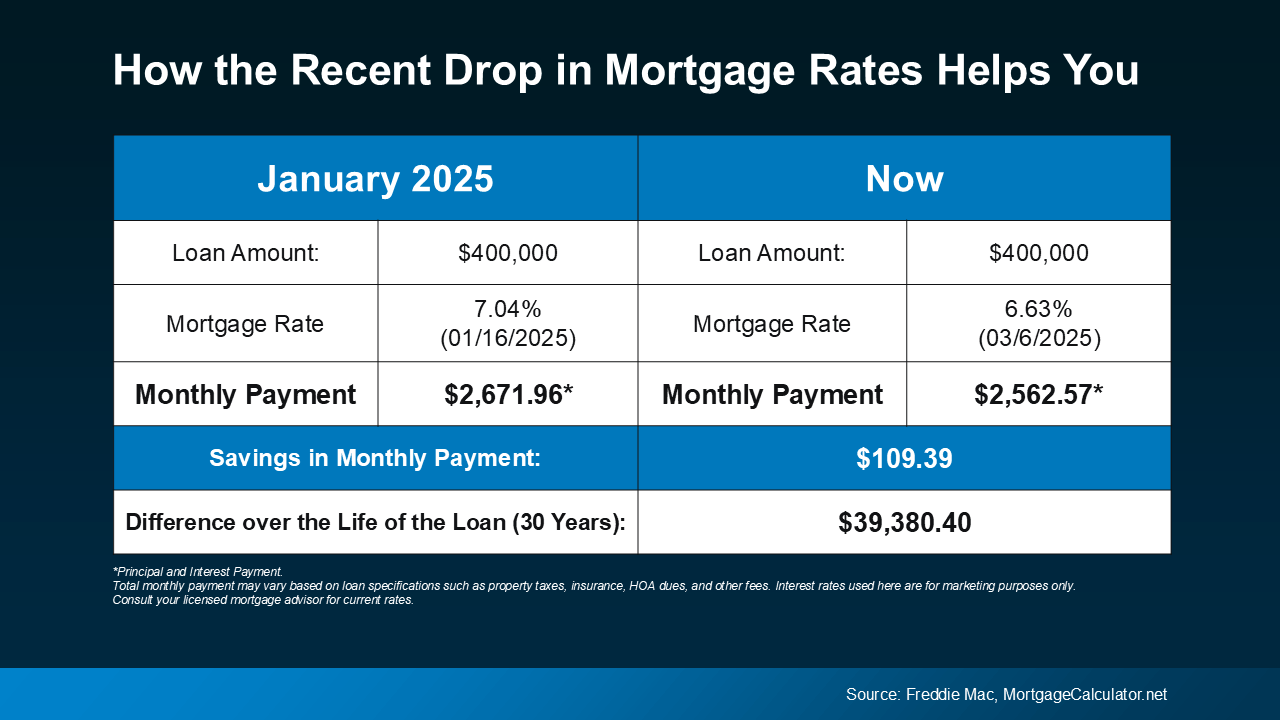

Even small changes in rates can make a difference to your monthly payment. Here’s how the math shakes out. The chart below shows what a monthly payment (principal and interest) would look like on a $400K home loan if you purchased a house when rates were 7.04% back in mid-January (this year’s mortgage rate high), versus what it could look like if you buy a home now (see below):

In just a matter of weeks, the anticipated payment on a $400K loan has come down by over $100 per month. That’s a significant savings. When you’re making a decision as big as buying a home, every bit counts.

In just a matter of weeks, the anticipated payment on a $400K loan has come down by over $100 per month. That’s a significant savings. When you’re making a decision as big as buying a home, every bit counts.

Just remember, shifts in the economy drove rates down faster than expected. But that can change, making rates volatile in the days and months ahead. So, if you’re waiting for rates to fall further before you buy, think hard about the current window of opportunity if you’re ready to act.

Bottom Line

Mortgage rates have dipped, giving buyers a bit more immediate breathing room. If you’ve been waiting for rates to ease before jumping in, this could be your window.

Would a lower monthly payment make buying a home feel more doable for you? Let’s break down the numbers and find out.

Do You Know How Much Your Home Is Worth?

Over the past few years, you’ve probably seen a whole lot of headlines about how home prices keep going up. But have you ever stopped to think about what that actually means for your home?

Home prices have risen dramatically over the past five years — far more than usual. And if selling has been on your mind, this could mean a bigger-than-expected payday when you list. So, how much has your home’s value really changed? Let’s break it down.

The Rapid Rise of the Past 5 Years

Typically, home prices go up by about 2-5% a year. But in 2021-2022, there were double-digit increases. And at the peak, prices rose by a staggering 20% or more nationally. Why? There were way more buyers than homes available, which sent prices soaring. While things have normalized since then, you still get to reap the benefits of those massive increases.

Your house has gained way more value than it normally would in such a short period of time – and that means a lot more wealth for you, too.

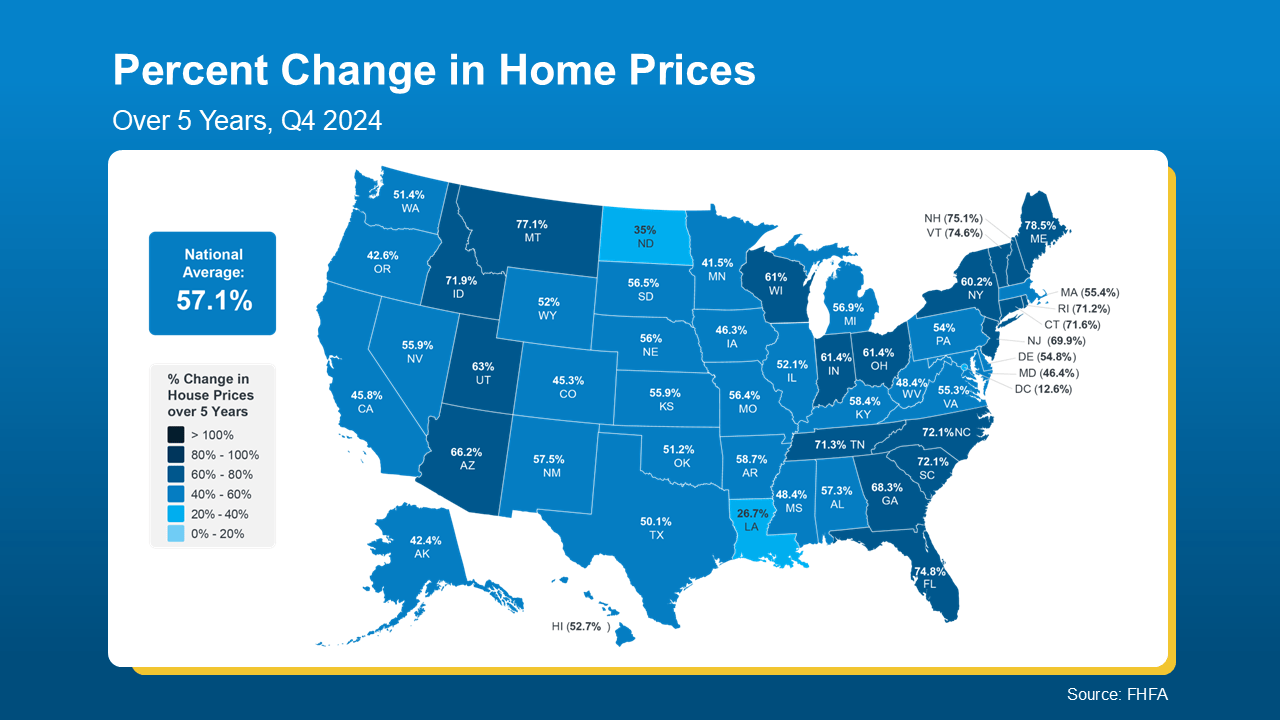

The map below uses data from the Federal Housing Finance Agency (FHFA) to show that, nationally, prices have gone up by nearly 60% in just the past 5 years alone. Here’s a breakdown that takes that one step further and gives you the numbers by state:

If you’ve been holding off on selling because you were worried about buying your next home at today’s rates and prices, let that sink in. It may be more than enough to help close the affordability gap and get you into your next house.

If you’ve been holding off on selling because you were worried about buying your next home at today’s rates and prices, let that sink in. It may be more than enough to help close the affordability gap and get you into your next house.

And what if you’ve been there for longer? That means your home’s value is probably even higher now. You get to stack the abnormal gains of the past 5 years on top of five years of more normal appreciation too. And an agent can help you figure out what that really looks like.

How To Find Out What Your House Is Really Worth

While a percentage is great, you probably want more specific numbers. The only way to get an accurate look at what your house is really worth is to talk to a local real estate agent.

While the map above gives you the average appreciation rate by state, it doesn’t take your local market into consideration. Like, is inventory still low where you live? That may drive prices higher, and faster. Or maybe you’ve done renovation that’ll add even more value to your house. Those are insights you’ll need an agent to provide.

An agent will know what’s happening where you live and can stack that up against the data and the condition of your home to give you the best estimate of its value possible. Only they have the data and expertise to find out your real number today.

Bottom Line

Home values have climbed — maybe more than you expected. Are you curious about what your house is worth in today’s market? Let’s connect so you can find out.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link