Why a Pre-Listing Inspection May Be Worth It in Today’s Market

Selling a house comes with a lot of moving pieces, and the last thing you want is a deal falling apart over unexpected repairs uncovered during the buyer’s inspection. That’s why it pays to anticipate potential issues before buyers ever step through the door. And one way to do that is with a pre-listing inspection.

What Is a Pre-Listing Inspection?

A pre-listing inspection is essentially a professional home inspection you schedule before putting your house on the market. Just like the inspections your buyer will do after making an offer, this process identifies any issues with the condition of your house that could have an impact on the sale – like structural problems, faulty or outdated HVAC systems, or other essential repairs.

While it’s a great option if you’re someone who really doesn’t like surprises, Bankrate explains this may not make sense for all sellers:

“While it can be beneficial for a seller to do, a pre-listing inspection isn’t always necessary. For example, if your home is relatively new and you’ve been the only owner, you’re most likely already aware of any big issues that could impact a sale. But for an older home, a pre-listing inspection can be very insightful and help you get ahead of any potential problems.“

The key is deciding whether the benefits outweigh the costs for your situation. Sometimes a few hundred dollars now can get you information that’ll save you a lot of time and hassle later on.

Why It May Be Worth Considering in Today’s Market

Right now, buyers are more cautious about how much money they’re spending. And they want to be sure the home they’re buying is worth the expense. In a market like this, a pre-listing inspection can be your secret weapon to make sure your house shows well. Here are just a few ways it can help:

- Gives You Time To Make Repairs: When you know about issues ahead of time, it gives you the chance to fix them on your schedule, rather than rushing to make repairs when you’re under contract.

- Avoid Surprises During Negotiations: When buyers discover issues during their own inspection, it can lead to last-minute negotiations, price reductions, or even a deal falling through. A pre-listing inspection gives you a chance to spot and address any problems ahead of time, so they don’t turn into last-minute headaches or negotiation roadblocks.

- Sell Your House Faster: According to Rocket Mortgage, if your house is listed in the best shape possible, there won’t be as many reasons for buyers to ask for concessions. That means you should be able to cut down on negotiation timelines and ultimately sell faster.

How Your Agent Will Help

But before you think about reaching out to any inspectors to get something scheduled, be sure to talk to an agent. Your agent will be able to give you advice on whether a pre-inspection is worthwhile for your house and the local market. Because it may not be as important if sellers still have the majority of the negotiation power where you live.

If your agent does recommend moving forward and getting one done, here’s how they’ll support you throughout the process.

- Offer Advice on How To Prioritize Repairs: If the inspection uncovers problems, your agent will sit down with you and offer perspective on what’s going to be a sticking point for buyers so you know what to prioritize.

- Knowledge of How To Handle Any Disclosure Requirements: After talking to your agent, you may decide not all of the repairs are worth it right now. Just be ready to disclose what you’re not tackling. Some states require disclosures as a part of a listing – lean on your agent for more information.

Bottom Line

While they’re definitely not required, pre-listing inspections can be especially helpful in today’s market. By understanding your home’s condition ahead of time, you can take control of the process and make informed decisions about what to fix before you list and what to disclose.

If you choose to skip this step, you may be just as surprised as your buyer by what pops up in their inspection. And that could leave you scrambling. Would you rather fix issues now or risk trying to save the deal later?

Let’s connect so you can see if this is a step that makes sense in our market.

How To Buy a Home Without Waiting for Lower Rates

Many people are hoping mortgage rates will come down before they buy a home. But will that actually happen? According to the latest forecasts, experts say rates will decline, but not by as much as a lot of people want.

The good news? Even if they don’t drop substantially, there are still ways to make buying a home more affordable.

How Much Will Rates Drop?

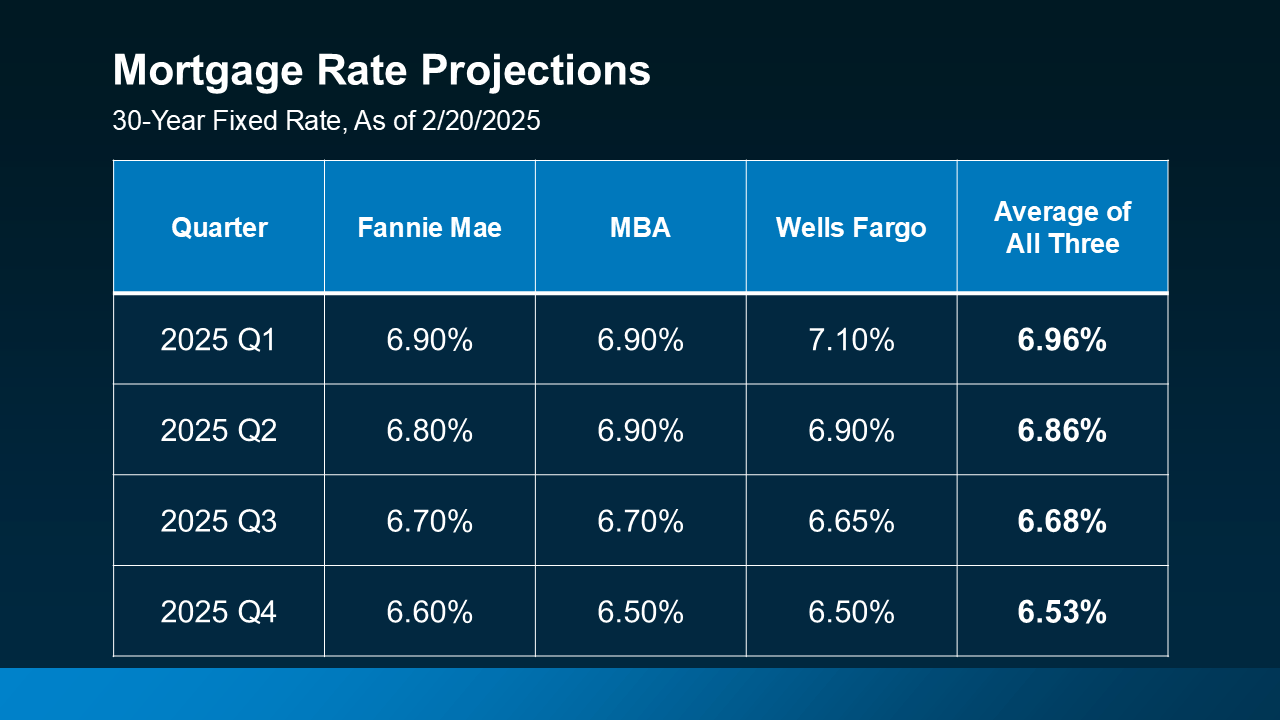

A few months ago, experts were forecasting mortgage rates could dip below 6% by the end of the year. But recent projections suggest that may not happen after all.

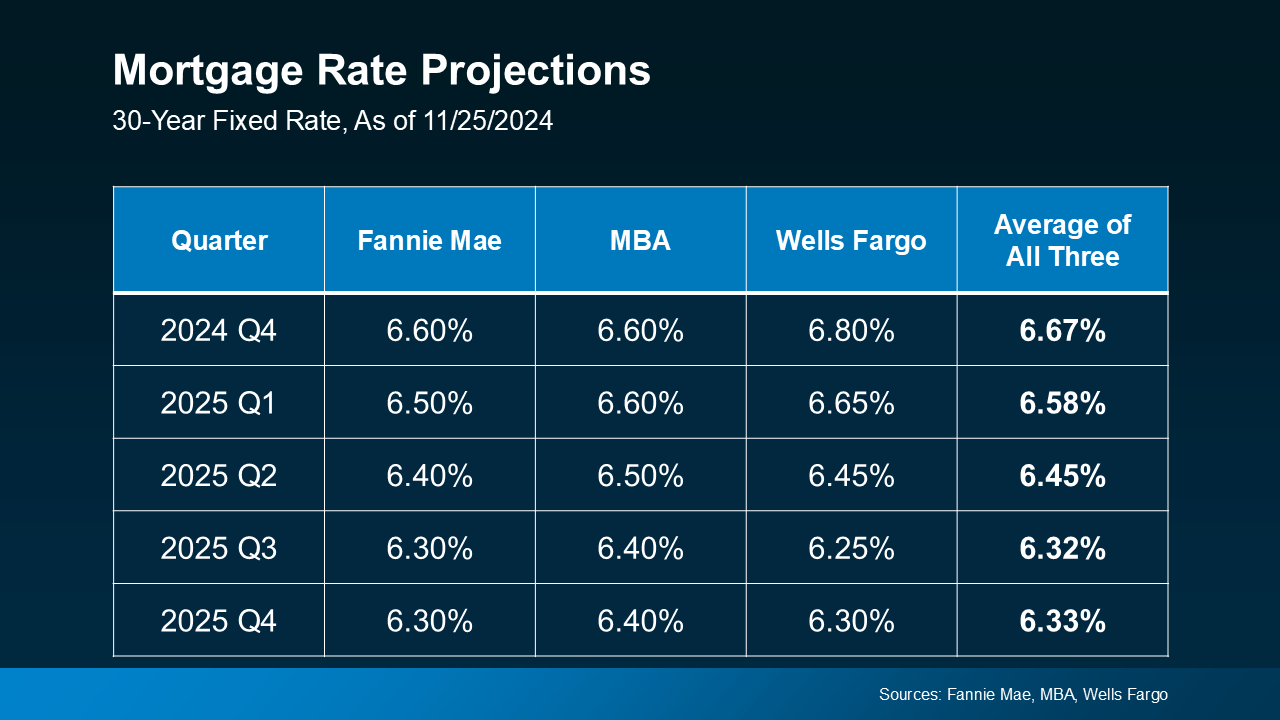

While mortgage rates are still expected to decline some later this year, projections from Fannie Mae, the Mortgage Bankers Association (MBA), and Wells Fargo now show them stabilizing closer to the 6.5% to 7% range (see below):

That means if you’re holding off on buying a home in hopes of much lower mortgage rates, you may be waiting a while. And if you need to move because something in your life has changed, like a new job, a new baby, or a marriage – waiting that long may not be an option.

That means if you’re holding off on buying a home in hopes of much lower mortgage rates, you may be waiting a while. And if you need to move because something in your life has changed, like a new job, a new baby, or a marriage – waiting that long may not be an option.

Creative Financing Options in Today’s Market

Since rates aren’t expected to decline as much as originally expected, it may be worth considering alternative financing options that could help you get into a home sooner rather than later. Here are three strategies to discuss with your lender to see if any of these make sense for you:

1. Mortgage Buydowns

A mortgage buydown allows you to pay an upfront fee to lower your mortgage rate for a set period of time. This can be especially helpful if you want or need a lower monthly payment early on. In fact, 27% of agents say first-time homebuyers are increasingly requesting buydowns from sellers in order to buy a home right now.

2. Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) typically start with a lower mortgage rate than a traditional 30-year fixed mortgage. This makes them an attractive option, especially if you expect rates to drop in the coming years or plan to refinance later.

And if you remember the housing crash, know that today’s ARMs aren’t like the risky ones back then. Lance Lambert, Co-Founder of ResiClub, helps drive this point home by saying:

“. . . ARM products today are different from many of the products issued in the mid-2000s. Before 2008, lenders often approved ARMs based on borrowers ability to pay the initial lower interest rates. And sometimes they didn’t even check that (remember Ninja loans). Today, adjustable-rate borrowers qualify based on their ability to cover a higher monthly payment, not just the initial lower payment.”

In simple terms, banks used to give loans without checking to see if buyers could afford them. Now, lenders verify income, assets, and jobs, reducing the risks associated with ARMs compared to the past.

3. Assumable Mortgages

An assumable mortgage allows you to take over the seller’s existing loan — including its lower mortgage rate. And with more than 11 million homes qualifying for this option according to U.S. News, it’s worth exploring if you want or need a better rate.

Bottom Line

Waiting for a big decline in mortgage rates may not be the best strategy. Instead, options like buydowns, ARMs, or assumable mortgages could make homeownership more affordable right now. Connect with a local lender to explore what works for you.

How does this impact your homebuying plans this year?

Two Resources That Can Help You Buy a Home Right Now

A recent report from Realtor.com says 20% of Americans don’t think homeownership is achievable. Maybe you feel the same way. With inflation driving up day-to-day expenses, saving enough to buy your first home is more of a challenge. But here’s the thing. With the right resources and help, you can still make it happen.

There are options that can help make buying a home possible today — even if your savings are limited or your credit isn’t perfect. Let’s explore just two of the solutions that could help get you into your first home no matter the market.

1. FHA Loans

If your down payment savings and your credit score aren’t where you want them to be, an FHA loan could be your pathway to buying a home. According to the U.S. Department of Housing and Urban Development (HUD) and Bankrate, the big perks of an FHA home loan are:

- Lower Down Payments: They typically require a smaller down payment than conventional loans, sometimes as low as 3.5% of the home’s purchase price.

- Lower Credit Score Requirements: They’re designed to help buyers with credit scores that might not qualify for conventional financing. This means, when conventional loans aren’t an option, you may still be able to get an FHA loan.

The first step is to connect with a lender who can help you explore your options and determine if you qualify.

2. Homeownership Assistance Programs

And if you need a more budget-friendly down payment, that’s not your only option. Did you know there are over 2,000 homeownership assistance programs available across the U.S. according to Down Payment Resource? And more than 75% of these programs are designed to help buyers with their down payment. Here’s a bit more information about why these could be such powerful tools for you:

- Financial Support: The average benefit for buyers who qualify for down payment assistance is $17,000. And that’s not a small number.

- Stackable Benefits: To make it even better, in some cases, you may be able to qualify for multiple programs at once, giving your down payment an even bigger boost.

Rob Chrane, CEO of Down Payment Resource confirms a little-known fact:

“Some of these programs can be layered. And so, in other words, you may not be limited to just one program.”

If you want to learn more or see what you qualify for, be sure to lean on the pros. A trusted real estate agent and a lender can guide you through the process, explain the help that’s out there, and connect you with resources to make buying a home a reality.

Bottom Line

If you’re ready to stop wondering if buying a home is possible and start exploring solutions, let’s connect.

3 Reasons To Buy a Home Before Spring

Let’s face it — buying a home can feel like a challenge with today’s mortgage rates. You might even be thinking, “Should I just wait until spring when more homes hit the market and rates might be lower?”

But here’s the thing, no one knows for sure where mortgage rates will go from here, and waiting could mean facing more competition, higher prices, and a lot more stress.

What if buying now — before the spring rush — might actually give you the upper hand? Here are three reasons why that just might be the case.

1. Less Competition from Other Buyers

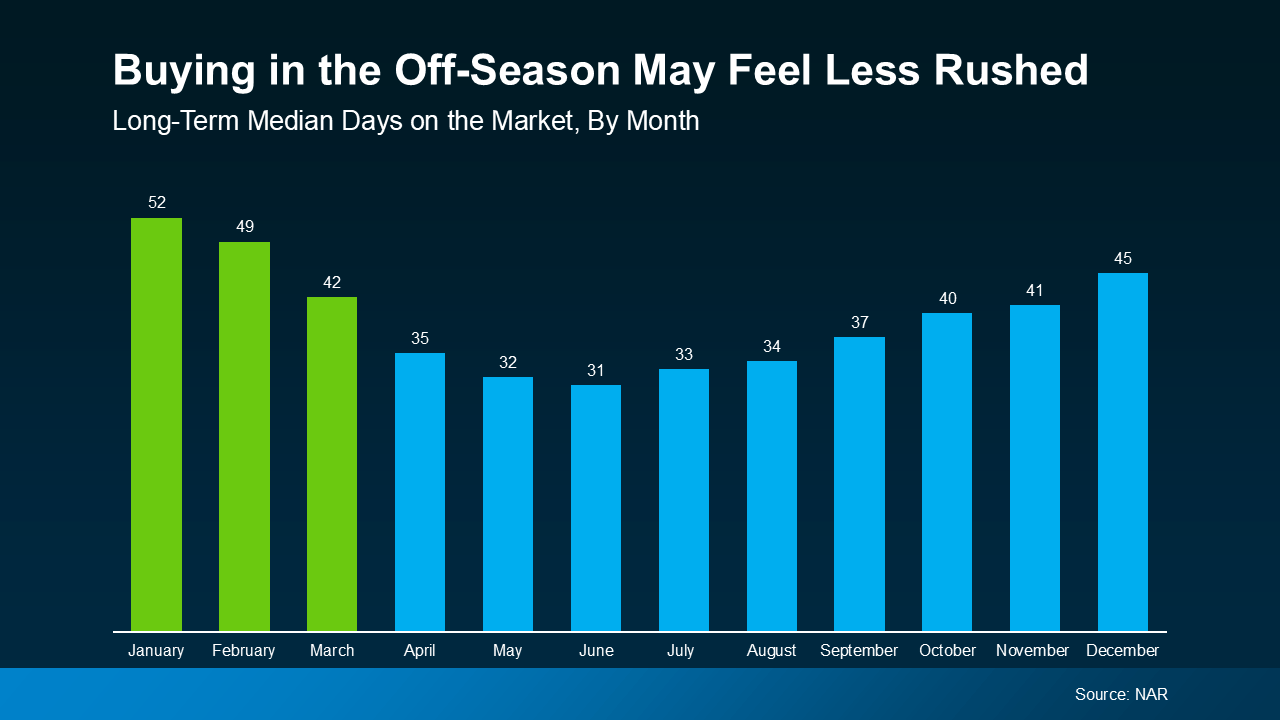

The winter months tend to be quieter in the real estate market. Fewer people are actively looking for homes, which means you’ll likely face less competition when you make an offer. This makes the process feel less rushed and less stressful.

According to the National Association of Realtors (NAR), homes sit on the market longer in winter compared to spring and summer (see graph below):

Fewer buyers in the market means you’ll likely have more time to make thoughtful decisions. It also means you may have more negotiating power. According to the Alabama Association of Realtors:

Fewer buyers in the market means you’ll likely have more time to make thoughtful decisions. It also means you may have more negotiating power. According to the Alabama Association of Realtors:

“A significant benefit of buying a home in winter is the reduced competition. Because of the perceived benefits of spring, many buyers delay the start of their house hunt. As a result, you will find fewer people competing for the same properties during winter. Less demand can translate into more negotiating power as sellers may be more willing to entertain offers or agree to concessions to get a deal closed quickly.”

2. More Negotiating Power

With homes staying on the market longer, sellers may be more willing to negotiate. This can lead to better deals for you as a buyer, whether that means a lower price or added incentives, like sellers covering closing costs or making repairs. As Chen Zhao, an Economist at Redfin, points out:

“. . . buying during the off season means less competition from other buyers. That means potentially negotiating a better deal.”

Plus, when demand is lower, sellers often feel more pressure to work with serious buyers. This could give you an edge to negotiate terms that work best for your situation.

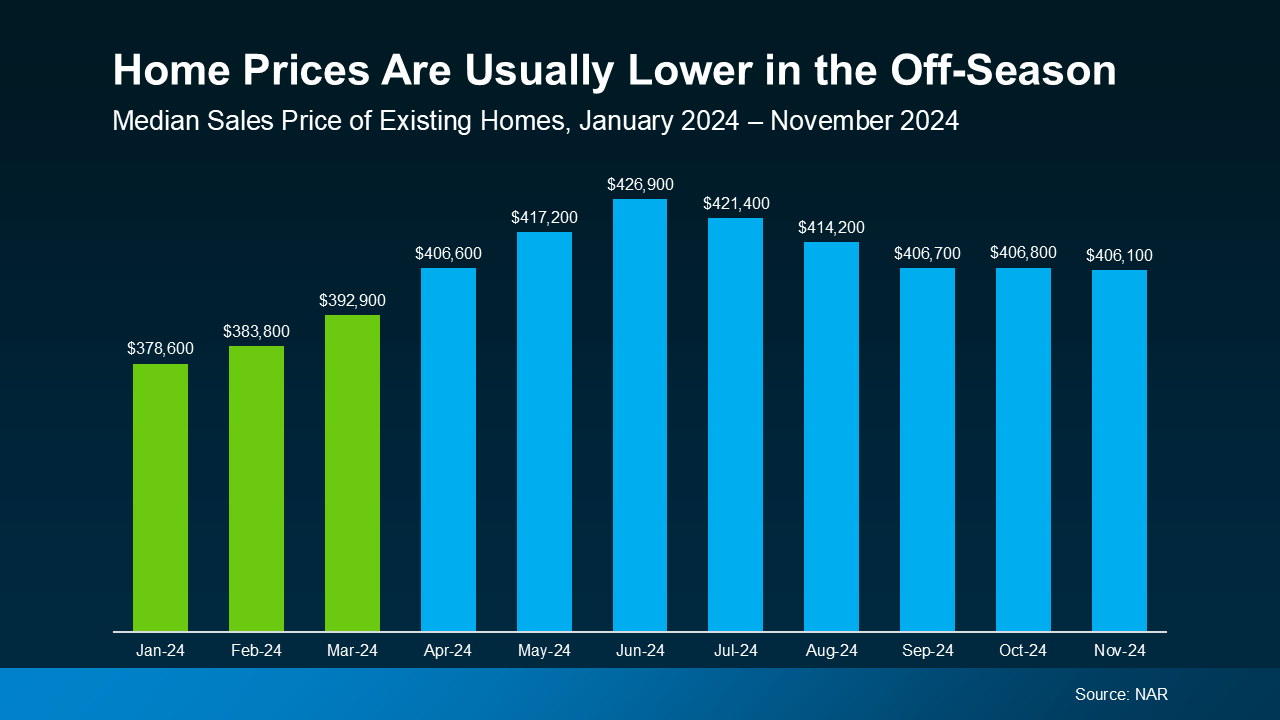

3. Lock in Today’s Prices Before They Rise

Historically, home prices tend to be at their lowest point in the winter months, too. According to data from NAR, home prices last year were at their lowest in January, February, and March — right before the spring buying season kicked in (see graph below):

This trend isn’t new — Bright MLS shows between 2010 and 2024, home prices in January and February were, on average, 15% lower than during the month of peak home prices (typically June). Buying in the off-season means you’re more likely to avoid paying the premium prices that come with the high demand of spring.

This trend isn’t new — Bright MLS shows between 2010 and 2024, home prices in January and February were, on average, 15% lower than during the month of peak home prices (typically June). Buying in the off-season means you’re more likely to avoid paying the premium prices that come with the high demand of spring.

On top of that, home prices generally appreciate over time, meaning they tend to go up year after year. That means if you’re ready to buy and you can make it happen, you’re not only taking advantage of what might be the lowest prices of the year, but you’re also locking in today’s price before it increases in the future.

Bottom Line

While spring may seem like the obvious time to buy, moving before the peak season can give you significant advantages, like less competition, more negotiation power, and lower prices.

If you’re ready to explore your options, let’s connect.

The Truth About Credit Scores and Buying a Home

Your credit score plays a big role in the homebuying process. It’s one of the key factors lenders look at to determine which loan options you qualify for and what your terms might be. But there’s a myth about credit scores that may be holding some buyers back.

The Myth: You Need To Have Perfect Credit

According to Fannie Mae, only 32% of potential homebuyers have a good idea of what credit score lenders actually require.

That means two-thirds of buyers don’t actually know what lenders are looking for – and most overestimate the minimum credit score needed.

The Reality: Perfect Isn’t Necessary

But the truth is, you don’t need perfect credit to become a homeowner. To see the average score, by loan type, for recent homebuyers check out the graph below:

There is no set cut-off score across the board. As FICO explains:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders, and there are many additional factors that lenders may use . . .”

So, even if your credit score isn’t as high as you’d like, you may still be able to get a home loan. Just know that, even though you don’t need perfect credit to buy a home, your score can have an impact on your loan options and the terms you’re able to get.

Work with a trusted lender who can walk you through what you’d qualify for.

Simple Tips To Improve Your Credit Score

If you want to open up your options a bit more after talking to a lender, here are a few tips from Experian and Freddie Mac that can help give your score a boost:

1. Pay Your Bills on Time

This includes everything from credit cards to utilities and other monthly payments. A track record of on-time payments shows lenders you’re responsible and reliable.

2. Pay Down Outstanding Debt

Reducing your overall debt not only improves your credit utilization ratio (how much credit you’re using compared to your total limit) but also makes you a lower-risk borrower in the eyes of lenders. That makes them more likely to approve a loan with better terms.

3. Hold Off on Applying for New Credit

While opening new credit accounts might seem like a quick way to boost your score, too many applications in a short period can have the opposite effect. Focus on improving your existing accounts instead.

Bottom Line

Your credit score doesn’t have to be perfect to qualify for a home loan. The best way to know where you stand? Work with a trusted lender to explore your options.

Mortgage Forbearance: A Helpful Option for Homeowners Facing Challenges

Let’s face it – life can throw some curveballs. Whether it’s a job loss, unexpected bills, or a natural disaster, financial struggles can happen to anyone. But here’s the good news. If you’re a homeowner feeling the squeeze, there’s a lifeline that many people don’t realize is still available: mortgage forbearance.

What Is Mortgage Forbearance?

As Bankrate explains:

“Mortgage forbearance is an option that allows borrowers to pause or lower their mortgage payments while dealing with a short-term crisis, such as a job loss, illness or other financial setback . . . When you can’t afford to pay your mortgage, forbearance gives you a chance to sort out your finances and get back on track.”

A common misconception is that forbearance was only accessible during the COVID-19 pandemic. While it did play a significant role in helping homeowners through that crisis, what many people don’t know is that forbearance is still a tool to support borrowers in times of need. Today, it remains a vital option to help homeowners in certain circumstances avoid delinquency and, ultimately, foreclosure.

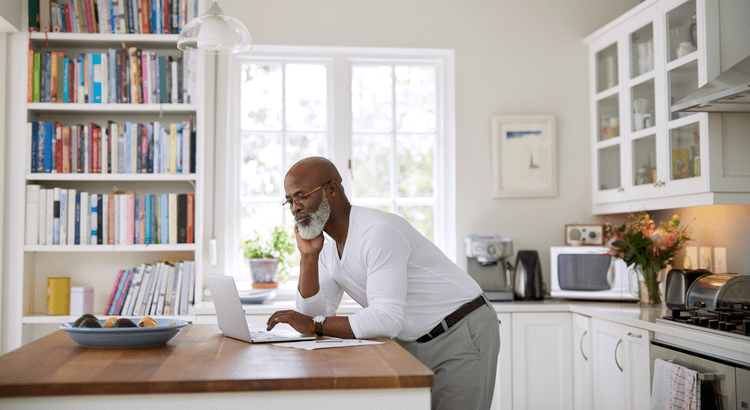

The Current State of Mortgage Forbearance

Forbearance continues to serve as a valuable safety net for homeowners facing temporary financial challenges. While the overall rate of forbearance has seen a slight increase recently, it’s important to understand what’s driving this change and how it fits into the broader picture.

According to Marina Walsh, VP of Industry Analysis at the Mortgage Bankers Association (MBA):

“The overall mortgage forbearance rate increased three basis points in November and has now risen for six consecutive months.”

This may seem concerning at first glance, but let’s break it down. The graph below, going all the way back to 2020, puts things into perspective:

While the share of mortgages in forbearance has significantly declined since its peak in mid-2020, there has been a slight but notable increase in recent months. This uptick is largely tied to the effects of two recent hurricanes — Helene and Milton.

While the share of mortgages in forbearance has significantly declined since its peak in mid-2020, there has been a slight but notable increase in recent months. This uptick is largely tied to the effects of two recent hurricanes — Helene and Milton.

Natural disasters like these often create temporary financial hardships for homeowners, making forbearance a crucial safety net during recovery. In fact, 46% of borrowers in forbearance today cite natural disasters as the reason for their financial struggles.

Even with the most recent uptick, the share of mortgages in forbearance is nowhere near pandemic levels, and, thankfully, reflects a very small portion of homeowners overall.

Why Forbearance Matters

Forbearance can help borrowers avoid the spiral of missed payments and foreclosure. It provides breathing room to address challenges and plan next steps. And while most homeowners today are not in a position to need forbearance, thanks to strong equity and foundations of the current housing market, it is an option for the few who do need it.

If you or a homeowner you know is facing financial difficulties, the first step is to contact your mortgage lender. They can walk you through the forbearance process and help you understand your options. Keep in mind that forbearance is not automatic — you need to apply and discuss the terms with your lender.

Bottom Line

In tough times, knowing your options can bring peace of mind. Forbearance isn’t just a financial tool — it’s a lifeline. And while the recent increase in forbearance rates might make headlines that give you pause, the truth is this option is working exactly as it should: helping those who need it most get through difficult moments without losing their homes.

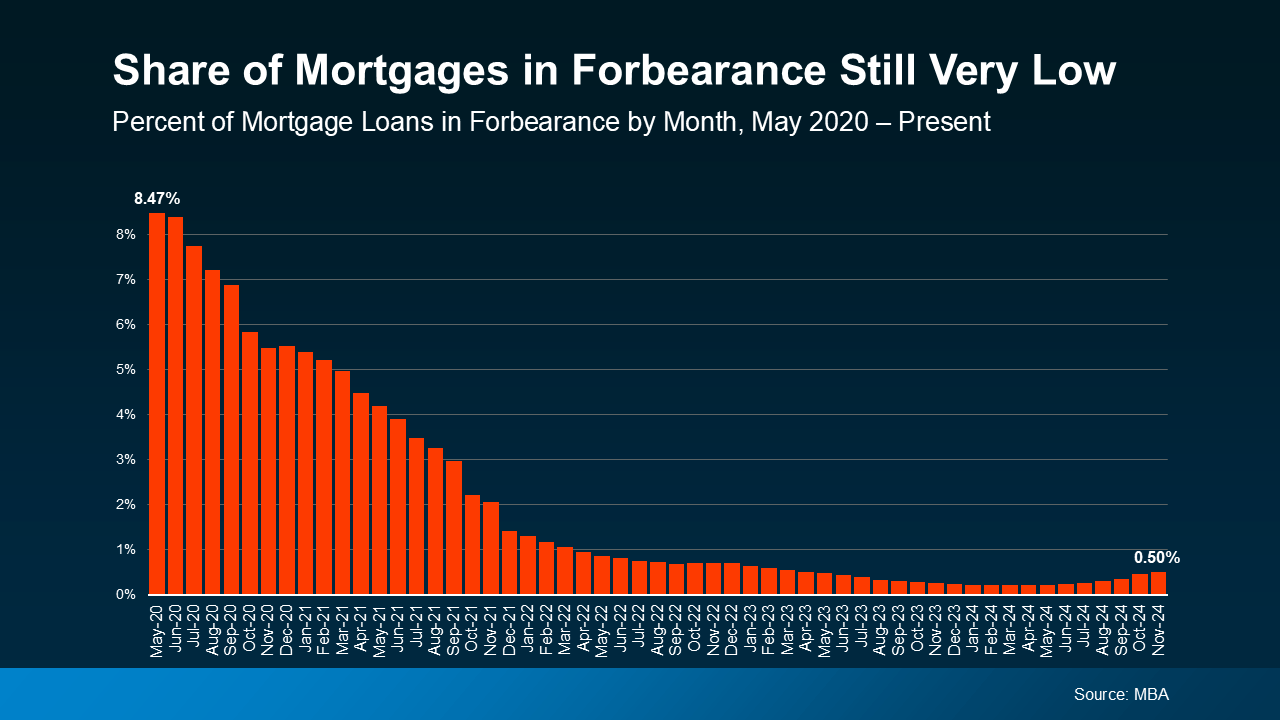

Should You Sell Your House As-Is or Make Repairs?

A recent study from the National Association of Realtors (NAR) shows most sellers (61%) completed at least minor repairs when selling their house. But sometimes life gets in the way and that’s just not possible. Maybe that’s why, 39% of sellers chose to sell as-is instead (see chart below):

If you’re feeling stressed because you don’t have the time, budget, or resources to tackle any repairs or updates, you may be tempted to sell your house as-is, too. But before you decide to go this route, here’s what you need to know.

If you’re feeling stressed because you don’t have the time, budget, or resources to tackle any repairs or updates, you may be tempted to sell your house as-is, too. But before you decide to go this route, here’s what you need to know.

What Does Selling As-Is Really Mean?

Selling as-is means you won’t make any repairs before the sale, and you won’t negotiate fixes after a buyer’s inspection. And this sends a signal to potential buyers that what they see is what they get.

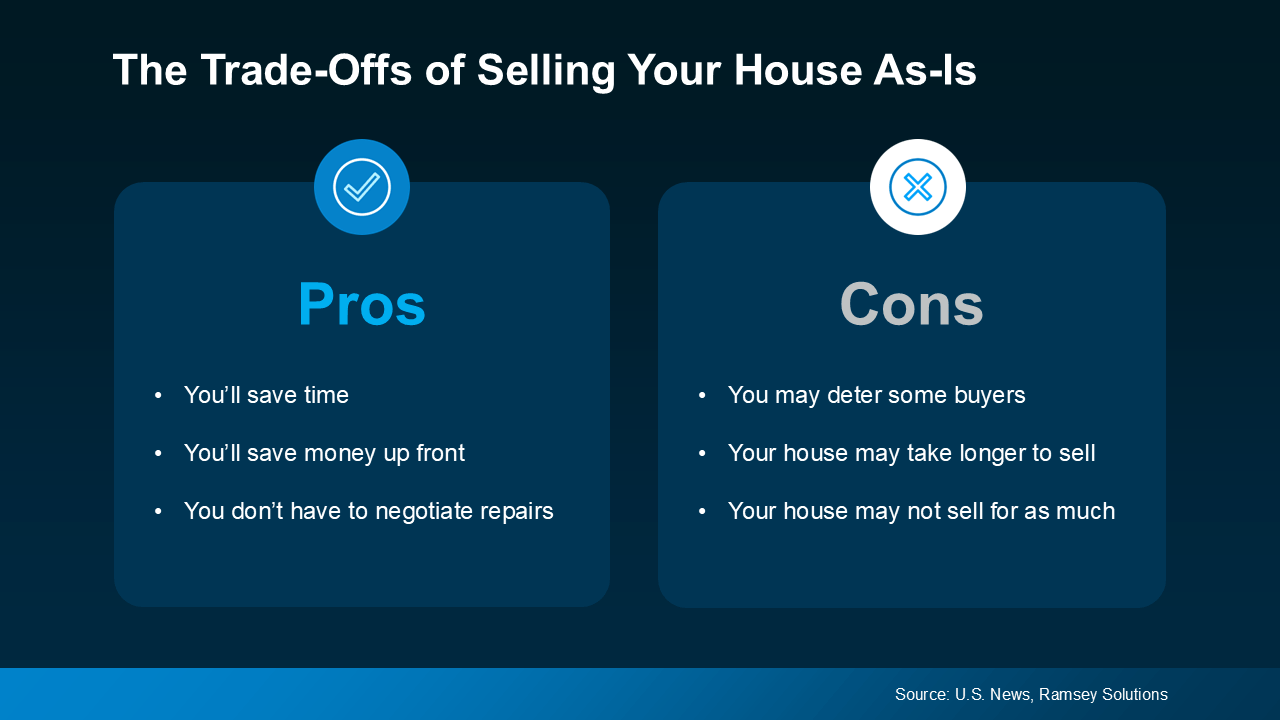

If you’re eager to sell but money or time is tight, this can be a relief because it’s that much less you’ll have to worry about. But there are a few trade-offs you’ll have to be willing to make. This visual breaks down some of the pros and cons:

Typically, a home that’s updated sells for more because buyers are often willing to pay a premium for something that’s move-in ready. That’s why you may find not as many buyers will look at your house if you sell it in its current condition. And less interest from buyers could mean fewer offers, taking longer to sell, and ultimately, a lower price. Basically, while it’s easier for you, the final sale price might be less than you’d get if you invested in repairs and upgrades.

Typically, a home that’s updated sells for more because buyers are often willing to pay a premium for something that’s move-in ready. That’s why you may find not as many buyers will look at your house if you sell it in its current condition. And less interest from buyers could mean fewer offers, taking longer to sell, and ultimately, a lower price. Basically, while it’s easier for you, the final sale price might be less than you’d get if you invested in repairs and upgrades.

That doesn’t mean your house won’t sell – it just means it may not sell for as much as it would in top condition.

Here’s the good news though. In today’s market, as many as 56% of buyers surveyed would be willing to buy a home that needs some work. That’s because affordability is still a challenge, and while there are more homes for sale right now, inventory is lower than the norm. So, you might find there are a few more buyers who may be willing to take on the work themselves.

How an Agent Can Help

So, how do you make sure you’re making the right decision for your move? The key is working with a pro.

A good agent will help you weigh your options by showing you what comparable homes in your area have sold for, what updates your neighbors are making, and guide you in setting a fair price no matter what you decide. That helps you anticipate what your house may sell for either way – and that can be a key factor in your final decision.

Once you’ve picked which route you’re going to go and the asking price is set, your agent will market your house to maximize its appeal. And if you decide to sell as-is, they’ll call attention to the best features, like the location, size, and more, so it’s easy for buyers to see the potential, not just projects.

Bottom Line

Selling a home without making any repairs is possible in today’s market, but it does have some trade-offs. To make sure you’re considering all your options and making the best choice possible, let’s have a conversation.

When Will Mortgage Rates Come Down?

One of the biggest questions on everyone’s minds right now is: when will mortgage rates come down? After several years of rising rates and a lot of bouncing around in 2024, we’re all eager for some relief.

While no one can project where rates will go with complete accuracy or the exact timing, experts offer some insight into what we might see going into next year. Here’s what the latest forecasts show.

Mortgage Rates Are Expected To Ease and Stabilize in 2025

After a lot of volatility and uncertainty, the most updated forecasts suggest rates will start to stabilize over the next year, and should ease a bit compared to where they are right now (see graph below):

As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“While mortgage rates remain elevated, they are expected to stabilize.”

Key Factors That’ll Impact the Future of Mortgage Rates

It’s important to note that the timing and the pace of what happens with mortgage rates is one of the most challenging forecasts to make in the housing market. That’s because these forecasts hinge on a few key factors all lining up. So don’t be fooled, because while rates are expected to come down slightly, they’re going to be a moving target. And the ups and downs of ongoing economic drivers will likely stick around. Here’s a look at just a few of the things that’ll influence where they go from here:

- Inflation: If inflation cools, rates could dip a bit more. On the flip side, if inflation rises or remains stubbornly high, rates may stay elevated longer.

- Unemployment Rate: The unemployment rate also plays a significant role in upcoming decisions by the Federal Reserve (the Fed). And while the Fed doesn’t set mortgage rates, their actions do reflect what’s happening in the greater economy, which can have an impact.

- Government Policies: With the next administration set to take office in January, fiscal and monetary policies could also affect how financial markets respond and where rates go from here.

Remember, these forecasts are based on the best information available right now. As new economic data comes out, experts will revise their projections accordingly. So, don’t try to time the market based on these forecasts alone.

Instead, the best thing you can do is focus on what you can control right now. Work on improving your credit score, put away any extra cash for your down payment, and automate your savings. All of these things will help you reach your homeownership goals even faster.

And be sure to connect with a trusted agent and a lender, so you always have the latest updates – and an expert opinion on what that means for your move.

Bottom Line

If you’re planning to move and want to stay informed about where mortgage rates are heading, let’s connect.

Why Today’s Mortgage Debt Isn’t a Sign of a Housing Market Crash

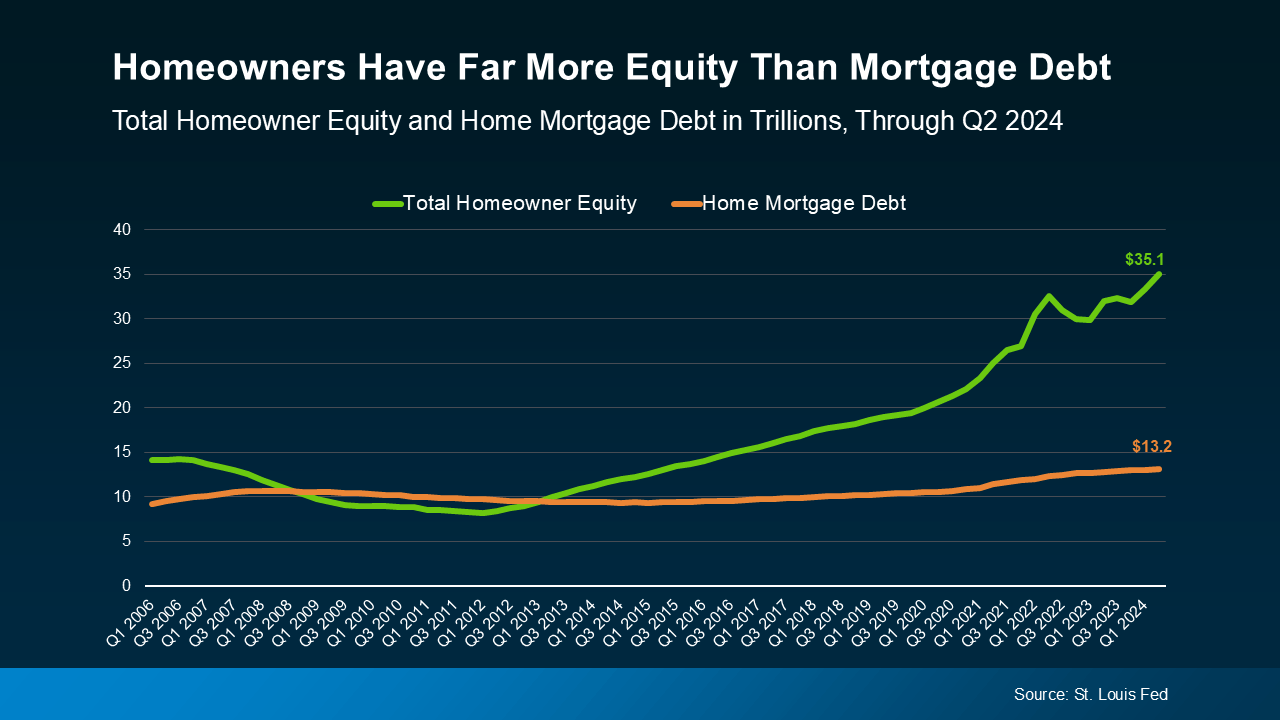

One major reason why we’re not heading toward a foreclosure crisis is the high level of equity homeowners have today. Unlike in the last housing bubble, where many homeowners owed more than their homes were worth, today’s homeowners have far more equity than debt.

That’s a big part of the reason why even though mortgage debt is at an all-time high, this isn’t 2008 all over again. As Bill McBride, Housing Analyst for Calculated Risk, explains:

“With the recent house price increases, some people are worried about a new housing bubble – but mortgage debt isn’t a concern . . .”

Today’s homeowners are in a much stronger position than ever before. So, let’s break it down and see why today’s mortgage debt isn’t anything to fear.

More Equity, Less Risk of Foreclosures

According to the St. Louis Fed, total homeowner equity is nearly triple the total mortgage debt today (see graph below):

High equity makes it less likely for homeowners to face foreclosure because they have more options. If someone struggles to make their mortgage payments, they could potentially sell their house and still come out ahead thanks to their built-up equity.

Even if home values were to dip, most homeowners would still have a comfortable cushion of equity. That’s a big contrast to the 2008 crisis, where many homeowners were underwater on their mortgages and had few options to avoid foreclosure.

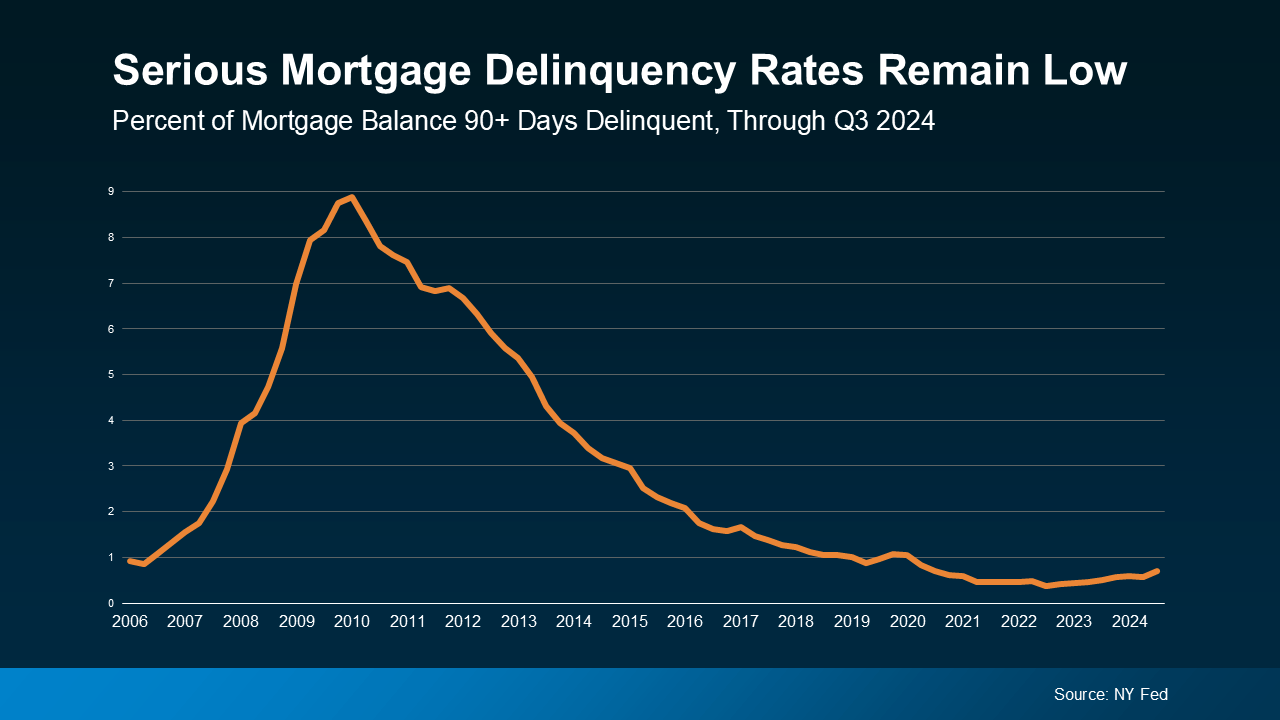

Delinquency Rates Are Still Near Historic Lows

Another reassuring sign is that, according to the NY Fed, the number of mortgage payments that are more than 90 days late is still near historic lows (see graph below):

This is partly due to a variety of programs designed to help homeowners through temporary hardships. As Marina Walsh, VP of Industry Analysis at the Mortgage Bankers Association (MBA), says:

“. . . servicers are helping at-risk homeowners avoid foreclosures through loan workout options that can mitigate temporary distress.”

So, even if someone falls behind on their payments, there are support systems in place to help them avoid foreclosure.

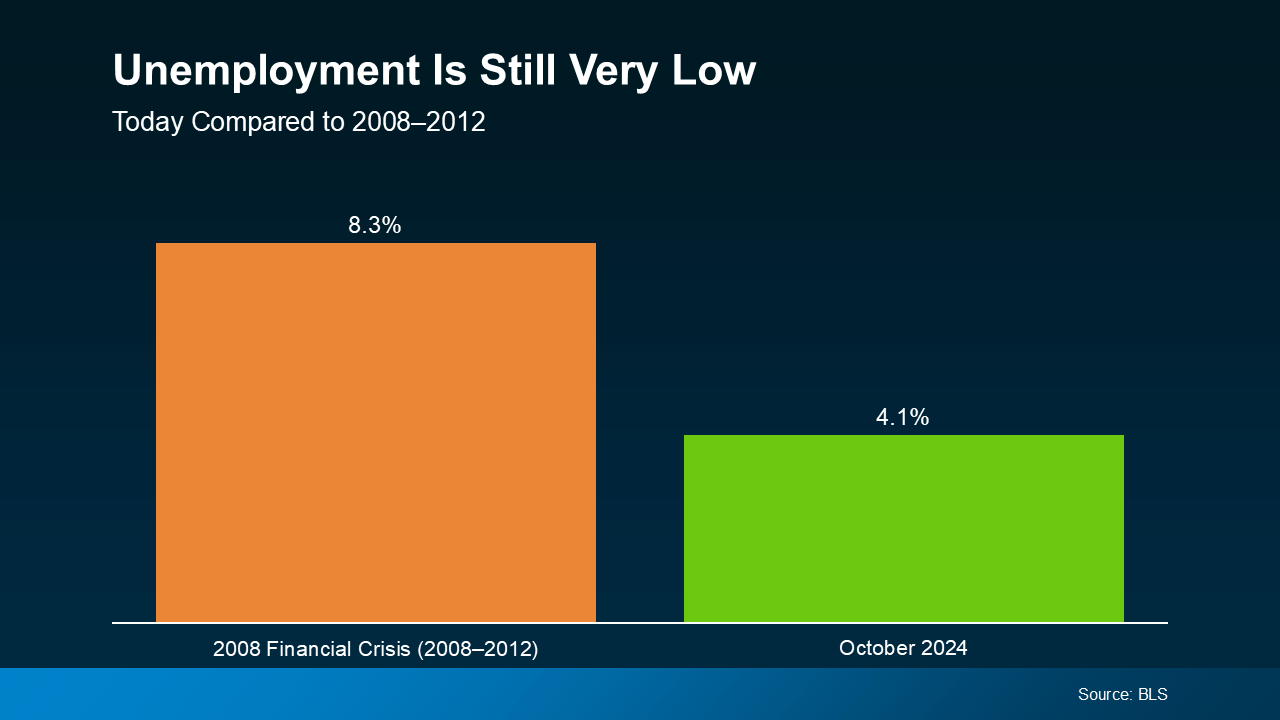

Low Unemployment Helps Keep the Market Stable

One other important factor is today’s low unemployment rate. More people have stable jobs, which means they’re better able to afford their mortgage payments. As Archana Pradhan, Principal Economist at CoreLogic, explains:

“Low unemployment numbers have helped reduce the overall delinquency rate . . .”

During the last housing crisis, unemployment was much higher, which led to a wave of foreclosures. Today’s unemployment rate is very different (see graph below):

That stability in how many people are employed is one of the reasons the market doesn’t have the same risks as it did the last time.

There’s no need to worry about a wave of distressed sales like the one we saw in 2008. Most homeowners today are employed and have low-interest mortgages they can afford, so they’re able to make their payments. As McBride states:

“The bottom line is there will not be a huge wave of distressed sales as happened following the housing bubble.”

Bottom Line

While mortgage debt is high, rest assured the market isn’t on the brink of another crash. Instead, most homeowners are in a strong position. If you have questions or concerns, let’s connect.

Don’t Miss Out on the Growing Number of Down Payment Assistance Programs

With rising home prices and volatile mortgage rates, it’s important you know about every resource that could help make buying a home possible. And one thing you’ll want to be aware of is just how much the number of down payment assistance (DPA) programs has grown lately.

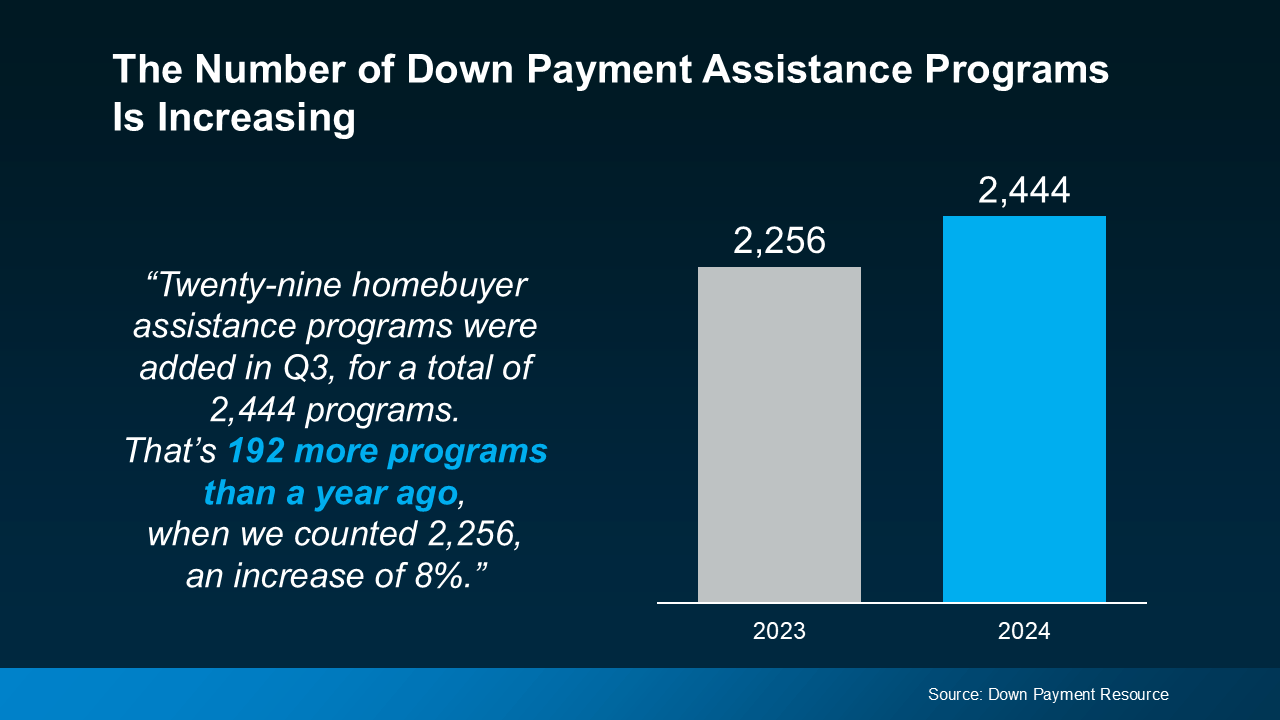

Take a look at the graph below to see how many new programs have been added in the last year, according to data from Down Payment Resource:

More Programs, More Opportunities for You

So, what does this increase mean for you? With more programs available, there’s a higher likelihood that one of them could help you reach your homeownership goals.

And these programs aren’t small-scale help either – the benefits can go a long way toward covering a chunk of your costs. As Rob Chrane, Founder and CEO of Down Payment Resource, shares:

“We are pleased to see a growing number of these programs, and think they are becoming a targeted way to help first-time and first-generation homebuyers struggling to save for a down payment get into a home they can afford. Our data shows the average DPA benefit is roughly $17,000. That can be a nice jump-start for saving for a down payment and other costs of homeownership.”

Imagine being able to qualify for $17,000 toward your down payment—that’s a big boost, especially if you’re looking to buy your first home. With that level of help, buying a home may be more within reach than you think.

But it’s worth calling out that the growth in DPA options isn’t just focused on first-time and first-generation buyers. Many of the new programs are also aimed at supporting affordable housing initiatives, which include manufactured and multi-family homes. This means that more people, and a wider variety of home types, can qualify for down payment assistance, making it easier for you to find an option that fits your needs.

Talk to a Real Estate Expert About What’s Available for You

With so many DPA programs out there, you need to make sure you’re finding the right one for you. That’s why it’s key to lean on your real estate and lending professionals for guidance. The Mortgage Reports says:

“The best way to find down payment assistance programs for which you qualify is to speak with your loan officer or broker. They should know about local grants and loan programs that can help you out.”

Your loan officer or real estate agent will know what’s available in your area and can point you toward programs that align with your goals.

Bottom Line

With more down payment assistance programs than ever before, now’s a great time to explore how these options can help on your homebuying journey. Let’s work together to make sure you’ve got a team of expert advisors in place to see which DPA programs could be a fit for you.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link